Question: Exercise 1 - 1 6 A ( Algo ) Applications of the Sarbanes - Oxley Act LO 1 - 6 The CFO of the Franklin

Exercise A Algo Applications of the SarbanesOxley Act LO

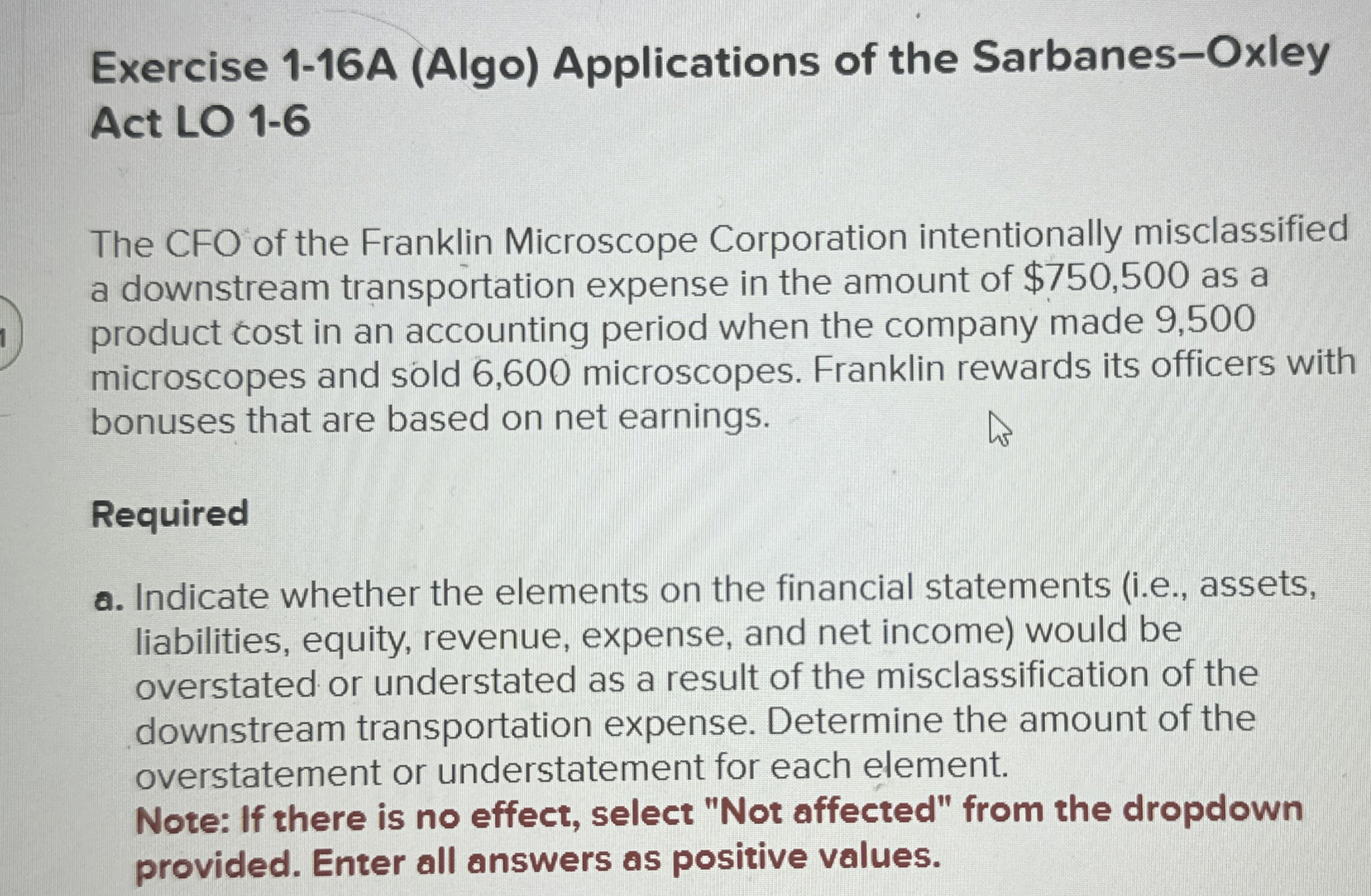

The CFO of the Franklin Microscope Corporation intentionally misclassified a downstream transportation expense in the amount of $ as a product cost in an accounting period when the company made microscopes and sold microscopes. Franklin rewards its officers with bonuses that are based on net earnings.

Required

a Indicate whether the elements on the financial statements ie assets, liabilities, equity, revenue, expense, and net income would be overstated or understated as a result of the misclassification of the downstream transportation expense. Determine the amount of the overstatement or understatement for each element.

Note: If there is no effect, select "Not affected" from the dropdown provided. Enter all answers as positive values.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock