Question: Exercise 1 - 1 8 Identifying sections of the statement of cash flows P 2 Indicate the section ( O , I, or F )

Exercise

Identifying sections of the statement of cash flows

P

Indicate the section I, or F where transactions through would appear on the statement of cash flows.

O Cash flows from operating activity

I. Cash flows from investing activity

F Cash flows from financing activity

Cash purchase of equipment

Cash withdrawal by owner

Cash paid for advertising

Cash paid for wages

Cash paid on account payable to supplier

Cash received from clients

Cash paid for rent

Cash investment by owner

Exercise

Identifying business activities

C

Match each transaction a through to one of the following activities of an organization: financing activity investing activity I or operating activity O

a An owner contributes cash to the business.

b An organization borrows money from a bank.

c An organization advertises a new product.

d An organization sells some of its land.

e An organization purchases equipment.

Exercise

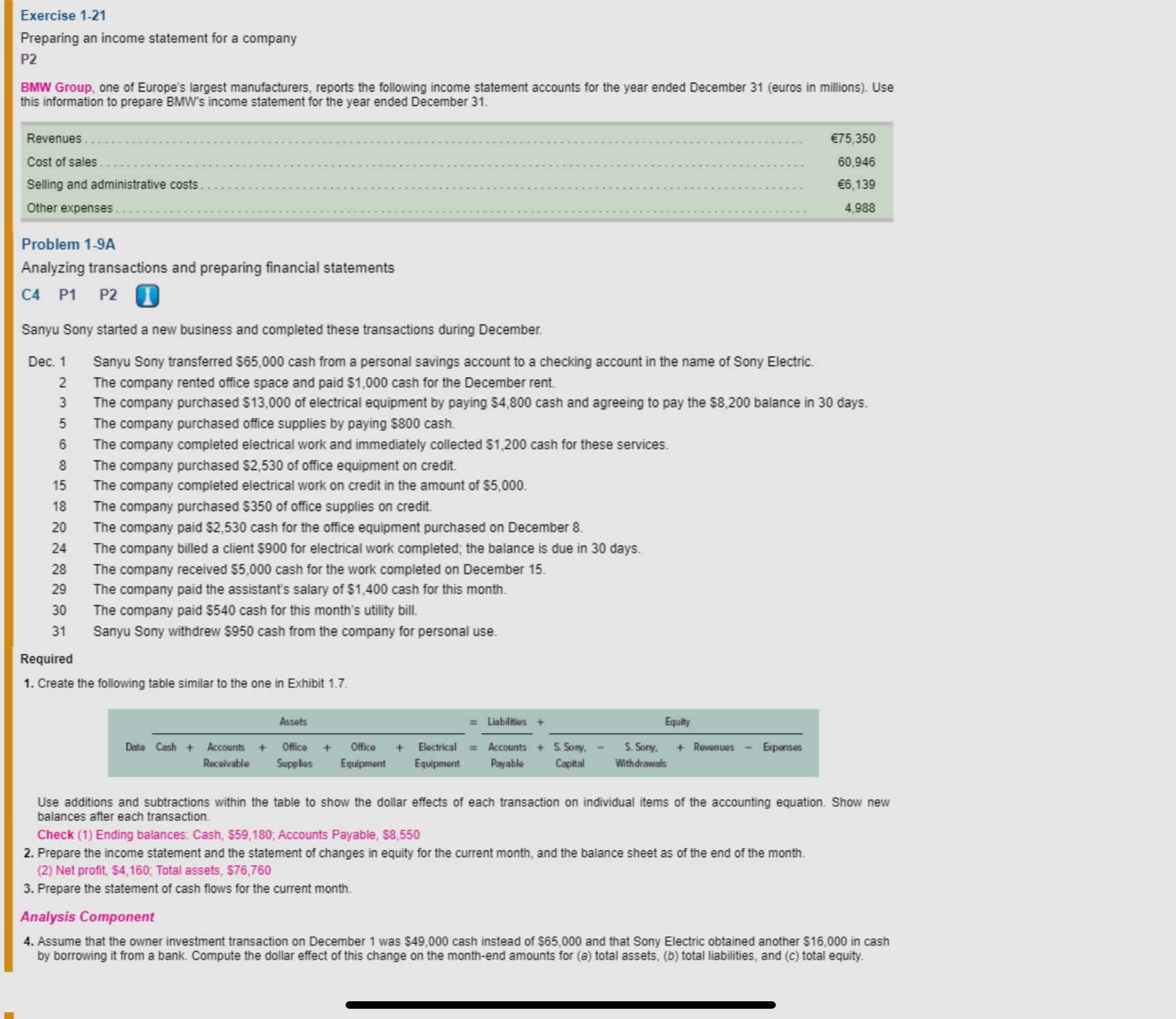

Preparing an income statement for a company

P

BMW Group, one of Europe's largest manufacturers, reports the following income statement accounts for the year ended December euros in millions Use

this information to prepare BMWs income statement for the year ended December

Problem A

Analyzing transactions and preparing financial statements

C P P

Sanyu Sony started a new business and completed these transactions during December.

Dec. Sanyu Sony transferred $ cash from a personal savings account to a checking account in the name of Sony Electric.

The company rented office space and paid $ cash for the December rent.

The company purchased $ of electrical equipment by paying $ cash and agreeing to pay the $ balance in days.

The company purchased office supplies by paying $ cash.

The company completed electrical work and immediately collected $ cash for these services.

The company purchased $ of office equipment on credit.

The company completed electrical work on credit in the amount of $

The company purchased $ of office supplies on credit.

The company paid $ cash for the office equipment purchased on December

The company billed a client $ for electrical work completed; the balance is due in days.

The company received $ cash for the work completed on December

The company paid the assistant's salary of $ cash for this month.

The company paid $ cash for this month's utility bill.

Sanyu Sony withdrew $ cash from the company for personal use.

Required

Create the following table similar to the one in Exhibit

Use additions and subtractions within the table to show the dollar effects of each transaction on individual items of the accounting equation. Show new

balances after each transaction.

Check Ending balances: Cash, $; Accounts Payable, $

Prepare the income statement and the statement of changes in equity for the current month, and the balance sheet as of the end of the month.

Net profit, $; Total assets, $

Prepare the statement of cash flows for the current month.

Analysis Component

Assume that the owner investment transaction on December was $ cash instead of $ and that Sony Electric obtained another $ in cash

by borrowing it from a bank. Compute the dollar effect of this change on the monthend amounts for a total assets, b total liabilities, and c total equity.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock