Question: Exercise 1 - 2 1 A On January 1 , Year 2 , the following information was drawn from the accounting records of Carter Company:

Exercise A

On January Year the following information was drawn from the accounting records of Carter Company: cash of $; land of $; notes payable of $; and common stock of $

Required

a Determine the amount of retained earnings as of January Year

b After looking at the amount of retained earnings, the chief executive officer CEO wants to pay a $ cash dividend to the stockholders. Can the company pay this dividend? Why or why not?

c As of January Year what percentage of the assets were acquired from creditors?

d As of January Year what percentage of the assets were acquired from investors?

e As of January Year what percentage of the assets were acquired from retained earnings?

f Create an accounting equation using percentages instead of dollar amounts on the right side of the equation.

g During Year Carter Company earned cash revenue of $ paid cash expenses of $ and paid a cash dividend of $ Prepare an income statement, statement of changes in stockholders' equity, a balance sheet, and a statement of cash flows dated December Year Hint: It is helpful to record these events under an accounting equation before preparing the statements.

h Comment on the terminology used to date each statement.

i An appraiser determines that, as of December Year the market value of the land is $ How will this fact change the financial statements?

j What is the balance in the Revenue account on January Year

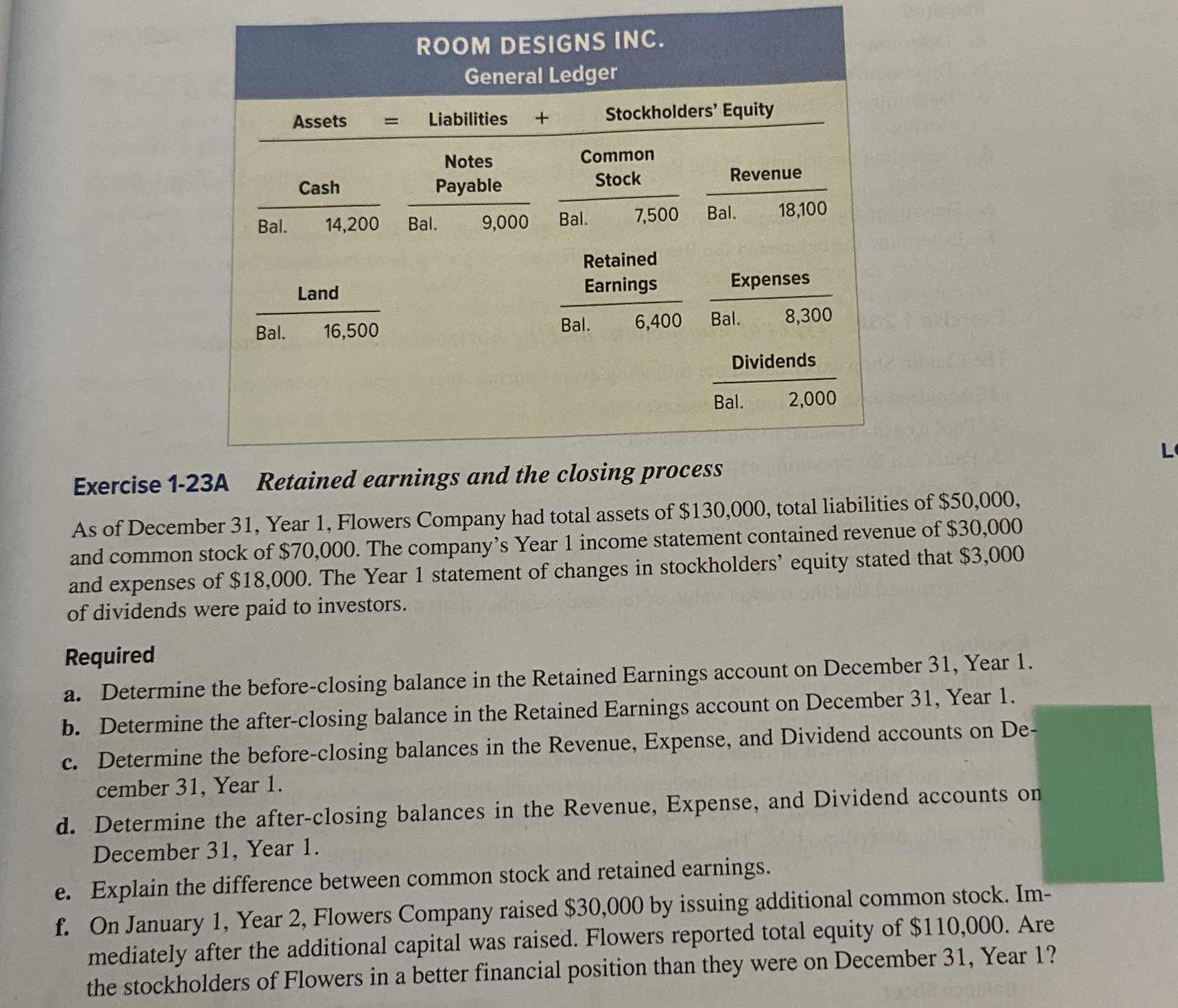

Exercise A Retained earnings and the closing process

As of December Year Flowers Company had total assets of $ total liabilities of $ and common stock of $ The company's Year income statement contained revenue of $ and expenses of $ The Year statement of changes in stockholders' equity stated that $ of dividends were paid to investors.

Required

a Determine the beforeclosing balance in the Retained Earnings account on December Year

b Determine the afterclosing balance in the Retained Earnings account on December Year

c Determine the beforeclosing balances in the Revenue, Expense, and Dividend accounts on December Year

d Determine the afterclosing balances in the Revenue, Expense, and Dividend accounts on December Year

e Explain the difference between common stock and retained earnings.

f On January Year Flowers Company raised $ by issuing additional common stock. Immediately after the additional capital was raised. Flowers reported total equity of $ Are the stockholders of Flowers in a better financial position than they were on December Year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock