Question: Exercise 1 - 2 5 A ( Algo ) Retained earnings and the closing process LO 1 - 9 Critz Company was started on January

Exercise A Algo Retained earnings and the closing process LO

Critz Company was started on January Year During the month of January, Critz earned $ of revenue and incurred $ of expenses. During the remainder of Year Critz earned $ and incurred $ of expenses. Critz closes its books on December of each year.

Required

a Determine the balance in the Retained Earnings account as of January Year

b Determine the balance in the revenue and expense accounts as of January Year

c Determine the balance in the Retained Earnings account as of December Year before closing.

d Determine the balances in the revenue and expense accounts as of December Year before closing.

e Determine the balance in the Retained Earnings account as of January Year

f Determine the balance in the revenue and expense accounts as of January Year

Complete this question by entering your answers in the tabs below.

Req A and

Req C and D

Req and

Determine the balances in the Retained Earnings, revenue and expense accounts as of January Year

tableJanuary Year a Retained earnings,b Revenue,b Expenses,

Exercise A Algo Missing information for determining net income LO

The December Year balance sheet for Deen Company showed total stockholders' equity of $ Total stockholders' equity increased by $ between December Year and December Year During Year Deen Company acquired $ cash from the issue of common stock. The Company paid a $ cash dividend to the stockholders during Year

Required

Determine the amount of net income or loss Deen reported on its Year income statement. Hint: Remember that stock issues, net income, and dividends all change total stockholders' equity.

The following events pertain to Super Cleaning Company:

Acquired $ cash from the issue of common stock.

Provided $ of services on account.

Provided services for $ cash.

Received $ cash in advance for services to be performed in the future.

Collected $ cash from the account receivable created in Event

Paid $ for cash expenses.

Performed $ of the services agreed to in Event

Incurred $ of expenses on account.

Paid $ cash in advance for oneyear contract to rent office space.

Paid $ cash on the account payable created in Event

Paid a $ cash dividend to the stockholders.

Recognized rent expense for nine months' use of office space acquired in Event

Required:

Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities OA investing activities IA or financing activities FA The first event is recorded as an example.

Note: Round your final answers to the nearest whole dollar. Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed.

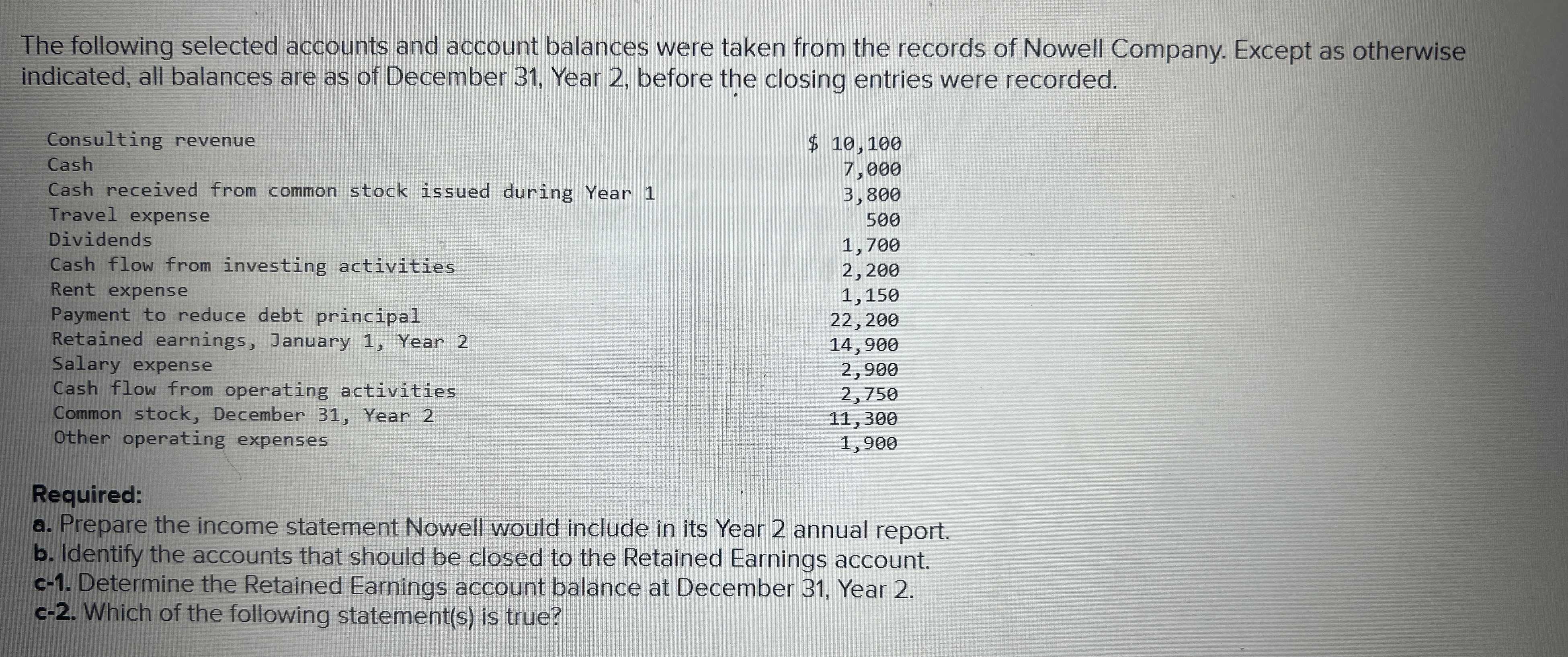

The following selected accounts and account balances were taken from the records of Nowell Company. Except as otherwise indicated, all balances are as of December Year before the closing entries were recorded.

tableConsulting revenue,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock