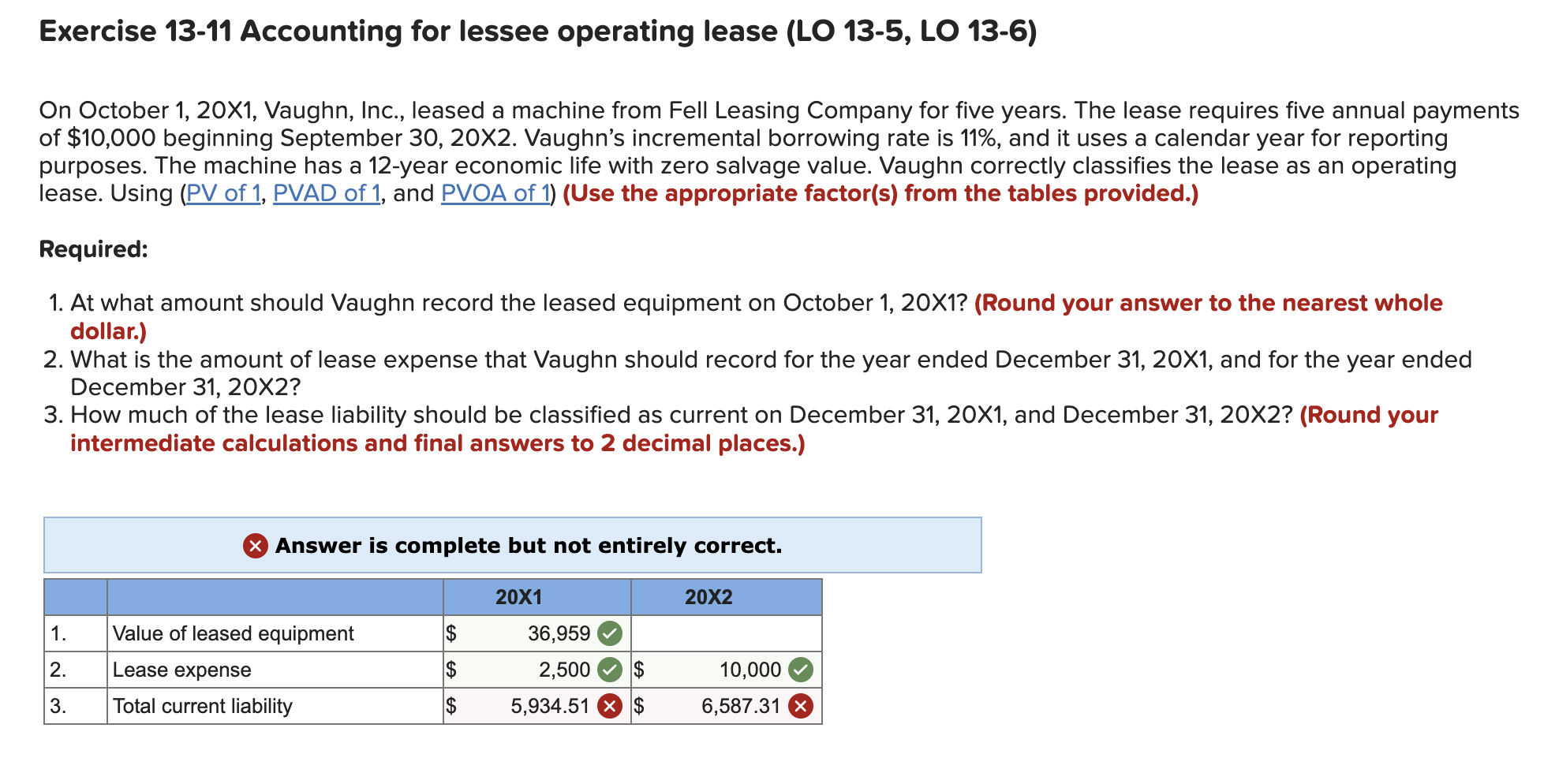

Question: Exercise 1 3 - 1 1 Accounting for lessee operating lease ( LO 1 3 - 5 , LO 1 3 - 6 ) On

Exercise Accounting for lessee operating lease LO LO

On October X Vaughn, Inc., leased a machine from Fell Leasing Company for five years. The lease requires five annual payments

of $ beginning September X Vaughn's incremental borrowing rate is and it uses a calendar year for reporting

purposes. The machine has a year economic life with zero salvage value. Vaughn correctly classifies the lease as an operating

lease. Using PV of PVAD of and PVOA of Use the appropriate factors from the tables provided.

How much of the lease liability should be classified as current on December X and December XRound your

intermediate calculations and final answers to decimal places.

Additional information from tables: is the PVOA at for periods, PV of $ for periods at is & for period it is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock