Question: Exercise 1 3 - 2 1 ( A l g o r i t h m i c ) ( L O . 1 ,

Exercise

Mini, Inc., earns pretax book net income $ its first year operations. Mini reported $ allowance

for bad debts its balance sheet for book purposes.

Mini reports $ pretax book net income Mini did not recognize any bad debt expense for book purposes

but did deduct $ bad debt expense for tax purposes. Mini reports other temporary permanent booktax

differences. The applicable Federal corporate income tax rate and Mini earns aftertax rate return capital

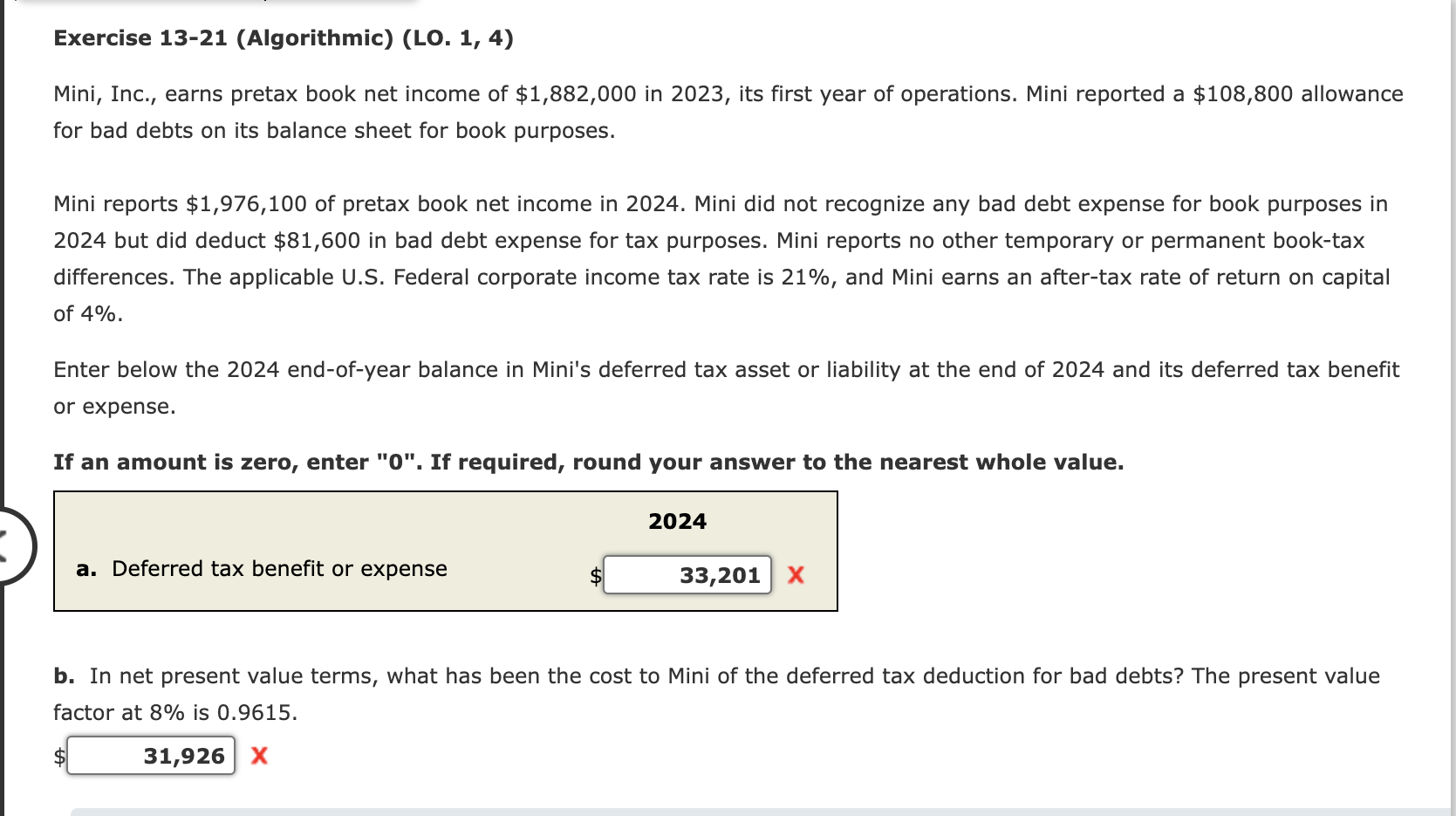

Enter below the endyear balance Mini's deferred tax asset liability the end and its deferred tax benefit

expense.

amount zero, enter required, round your answer the nearest whole value.

Deferred tax benefit expense

net present value terms, what has been the cost Mini the deferred tax deduction for bad debts? The present value

factor

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock