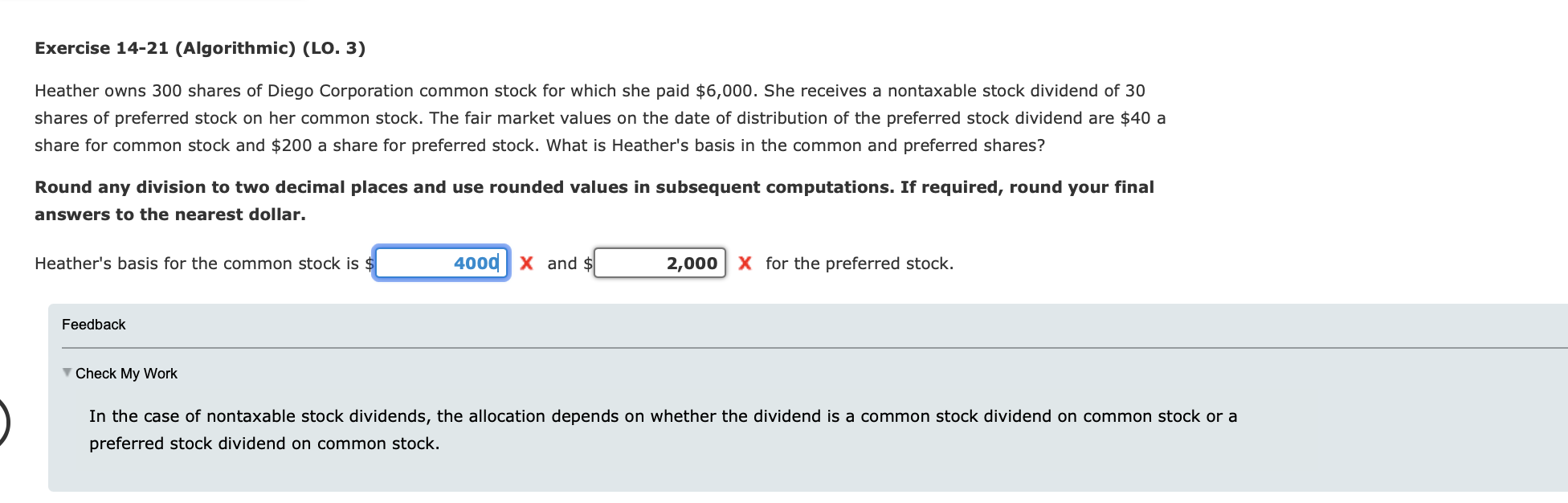

Question: Exercise 1 4 - 2 1 ( Algorithmic ) ( LO . 3 ) Heather owns 3 0 0 shares of Diego Corporation common stock

Exercise AlgorithmicLO

Heather owns shares of Diego Corporation common stock for which she paid $ She receives a nontaxable stock dividend of

shares of preferred stock on her common stock. The fair market values on the date of distribution of the preferred stock dividend are $ a

share for common stock and $ a share for preferred stock. What is Heather's basis in the common and preferred shares?

Round any division to two decimal places and use rounded values in subsequent computations. If required, round your final

answers to the nearest dollar.

Heather's basis for the common stock is $

and $

X for the preferred stock.

Feedback

T Check My Work

In the case of nontaxable stock dividends, the allocation depends on whether the dividend is a common stock dividend on common stock or a

preferred stock dividend on common stock. I got and and it said it was wrong I do not know what to do

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock