Question: Exercise 1 5 - 1 3 ( Algo ) Lessee; operating lease; financial statement effects [ LO 1 5 - 4 ] At January 1

Exercise Algo Lessee; operating lease; financial statement effects LO

At January Caf Med leased restaurant equipment from Crescent Corporation under a nineyear lease agreement.

The lease agreement specifies annual payments of $ beginning January the beginning of the lease, and on each December thereafter through

The equipment was acquired recently by Crescent at a cost of $ its fair value and was expected to have a useful life of years with no salvage value at the end of its life.

Because the lease term is only years, the asset does have an expected residual value at the end of the lease term of $

Crescent seeks a return on its lease investments.

By this arrangement, the lease is deemed to be an operating lease.

Note: Use tables, Excel, or a financial calculator. FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and PVAD of $

Required:

What will be the effect of the lease on Caf Med's earnings for the first year ignore taxes

Note: Enter decreases with negative sign.

What will be the balances in the balance sheet accounts related to the lease at the end of the first year for Caf Med ignore taxes

Note: For all requirements, round your intermediate calculations and final answers to the nearest whole dollars.

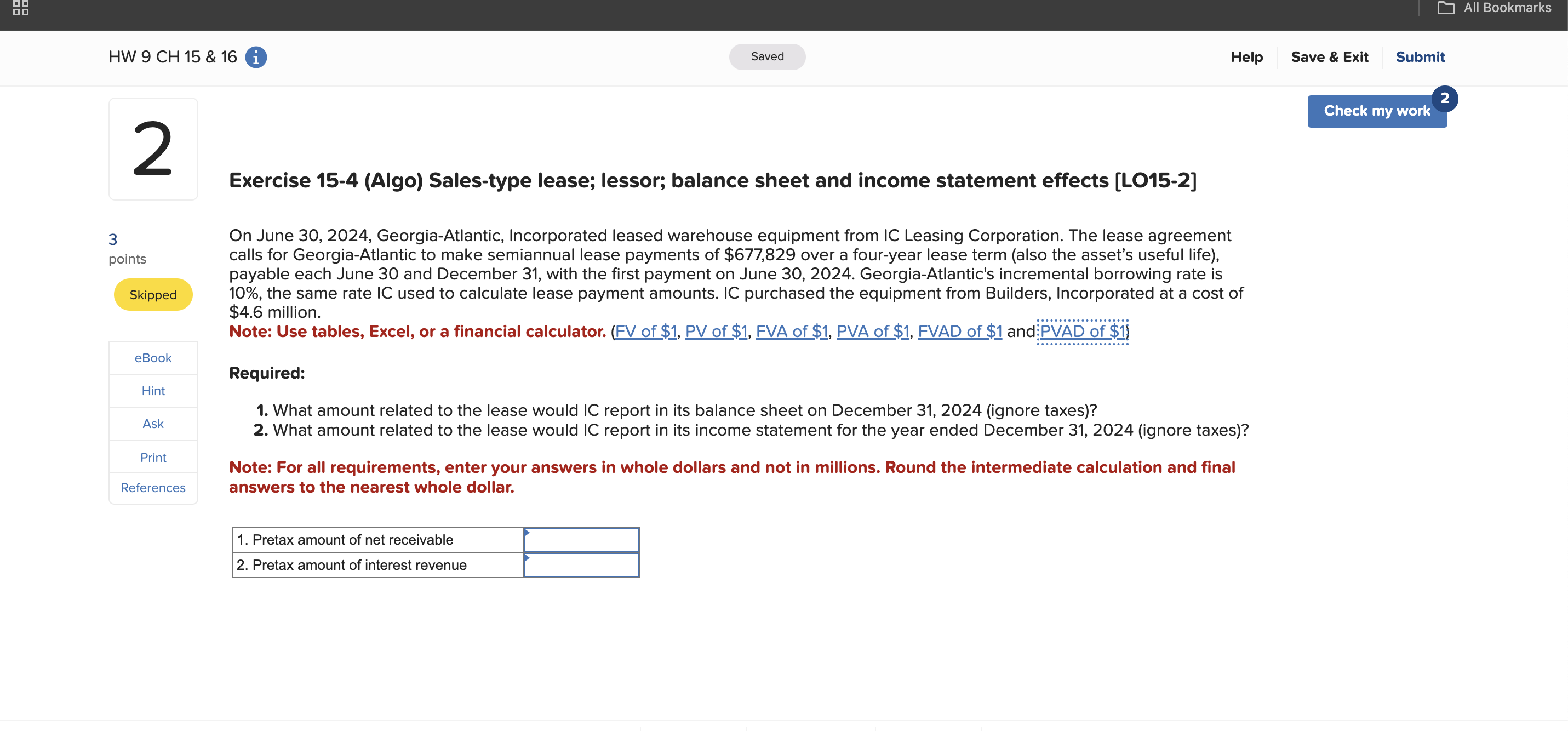

Exercise Algo Salestype lease; lessor; balance sheet and income statement effects LO

On June GeorgiaAtlantic, Incorporated leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for GeorgiaAtlantic to make semiannual lease payments of $ over a fouryear lease term also the asset's useful life payable each June and December with the first payment on June GeorgiaAtlantic's incremental borrowing rate is the same rate IC used to calculate lease payment amounts. IC purchased the equipment from Builders, Incorporated at a cost of $ million.

Note: Use tables, Excel, or a financial calculator. FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and:PVAD of $i

Required:

What amount related to the lease would IC report in its balance sheet on December ignore taxes

What amount related to the lease would IC report in its income statement for the year ended December ignore taxes

Note: For all requirements, enter your answers in whole dollars and not in millions. Round the intermediate calculation and final answers to the nearest whole dollar.

Pretax amount of net receivable

Pretax amount of interest revenue

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock