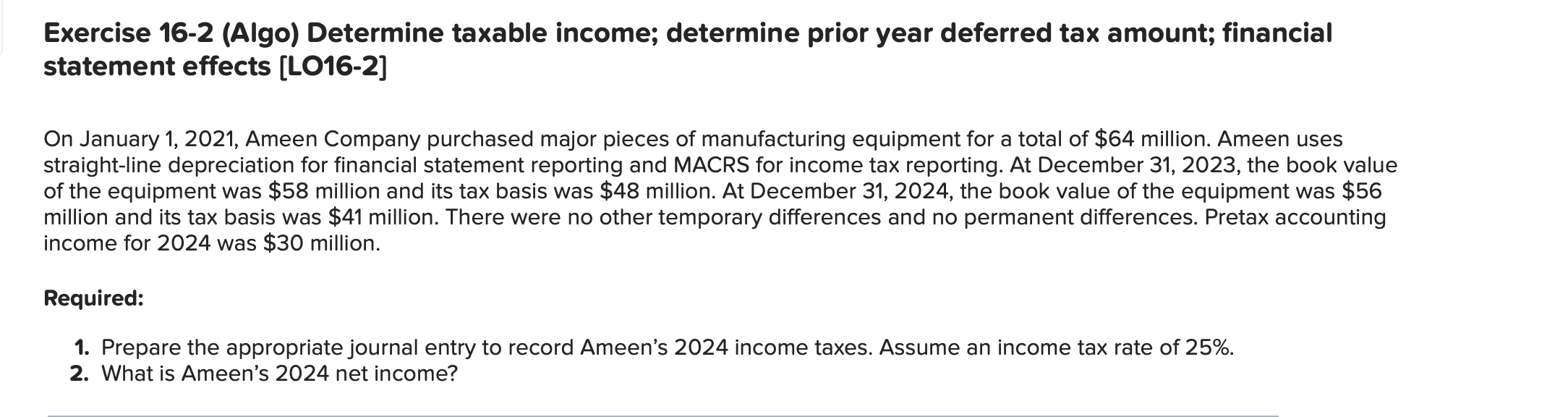

Question: Exercise 1 6 - 2 ( Algo ) Determine taxable income; determine prior year deferred tax amount; financial statement effects [ L 0 1 6

Exercise Algo Determine taxable income; determine prior year deferred tax amount; financial

statement effects L

On January Ameen Company purchased major pieces of manufacturing equipment for a total of $ million. Ameen uses

straightline depreciation for financial statement reporting and MACRS for income tax reporting. At December the book value

of the equipment was $ million and its tax basis was $ million. At December the book value of the equipment was $

million and its tax basis was $ million. There were no other temporary differences and no permanent differences. Pretax accounting

income for was $ million.

Required:

Prepare the appropriate journal entry to record Ameen's income taxes. Assume an income tax rate of

What is Ameen's net income?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock