Question: Exercise 1 6 - 3 3 ( Algorithmic ) ( LO . 5 ) Jebali Corporation, a calendar year taxpayer utilizing the completed contract method

Exercise AlgorithmicLO

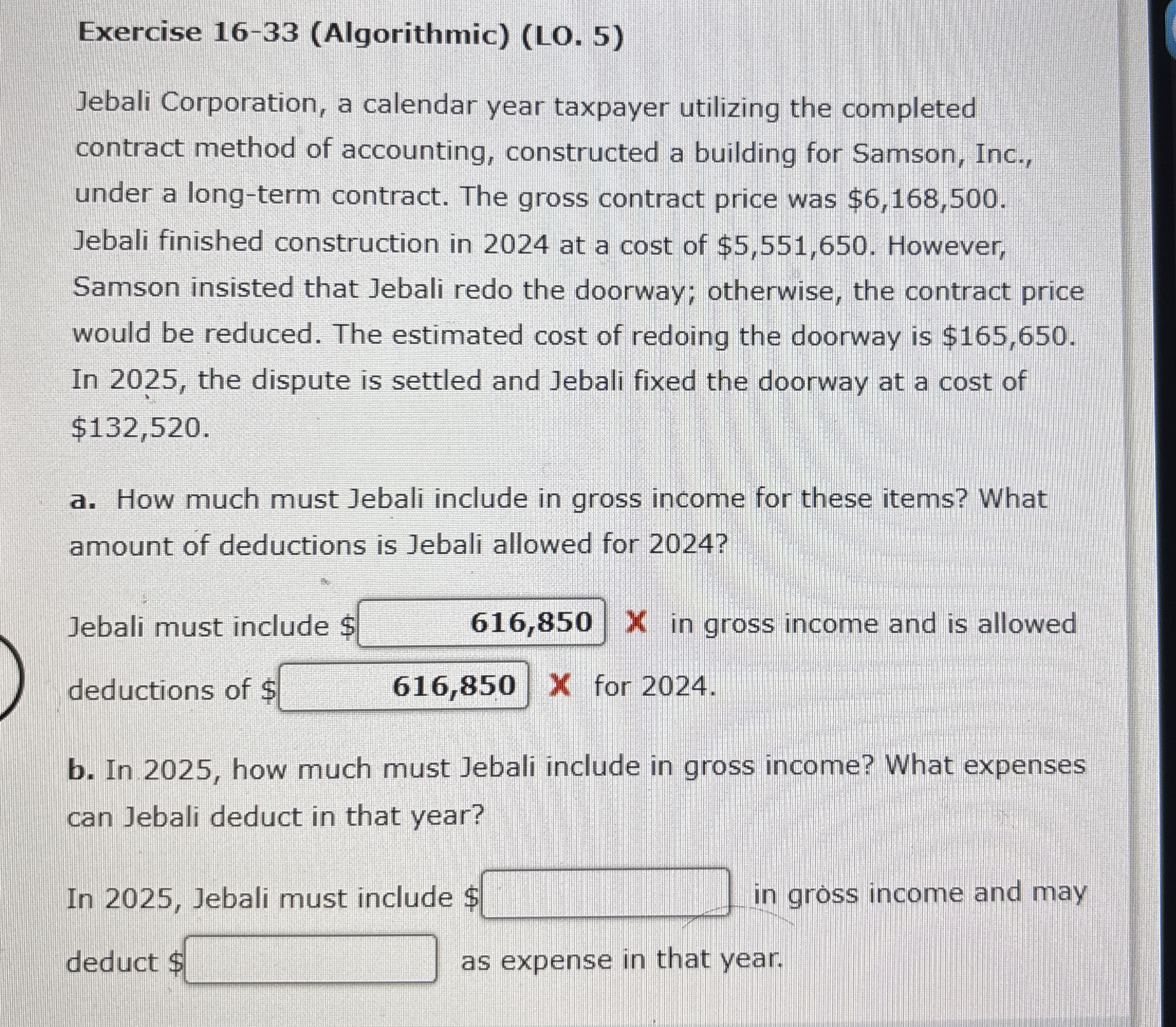

Jebali Corporation, a calendar year taxpayer utilizing the completed contract method of accounting, constructed a building for Samson, Inc., under a longterm contract. The gross contract price was $ Jebali finished construction in at a cost of $ However, Samson insisted that Jebali redo the doorway; otherwise, the contract price would be reduced. The estimated cost of redoing the doorway is $ In the dispute is settled and Jebali fixed the doorway at a cost of $

a How much must Jebali include in gross income for these items? What amount of deductions is Jebali allowed for

Jebali must include $ in gross income and is allowed deductions of $ for

b In how much must Jebali include in gross income? What expenses can Jebali deduct in that year?

In Jebali must include $ in gross income and may deduct $ as expense in that year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock