Question: Exercise 1 6 - 6 ( Algo ) Financial Ratios for Assessing Market Performance [ LO 1 6 - 6 ] Comparative financial statements for

Exercise Algo Financial Ratios for Assessing Market Performance LO

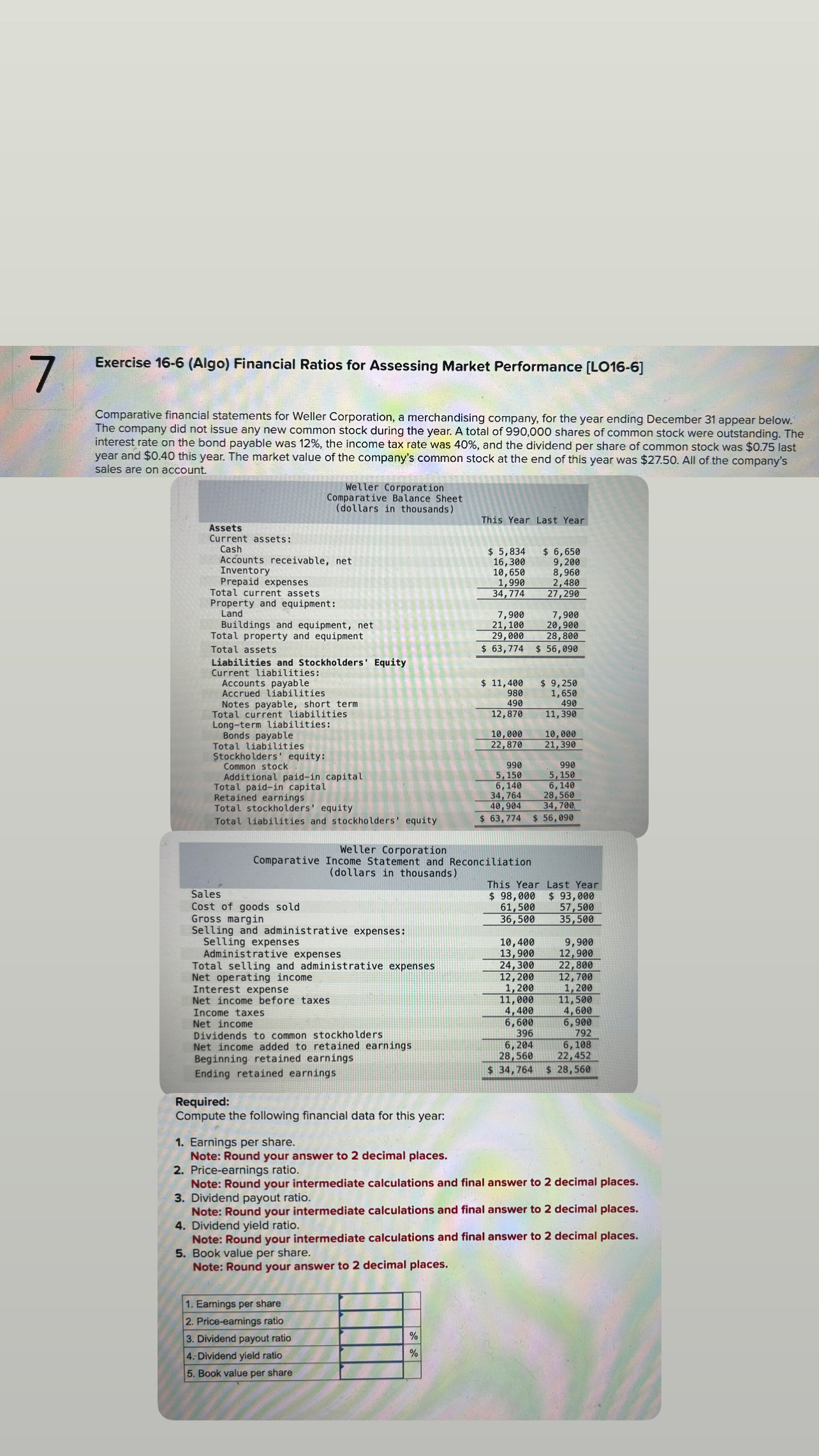

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December appear below. The company did not issue any new common stock during the year. A total of shares of common stock were outstanding. The interest rate on the bond payable was the income tax rate was and the dividend per share of common stock was $ last year and $ this year. The market value of the company's common stock at the end of this year was $ All of the company's sales are on account.

Required:

Compute the following financial data for this year:

Earnings per share.

Note: Round your answer to decimal places.

Priceearnings ratio.

Note: Round your intermediate calculations and final answer to decimal places.

Dividend payout ratio.

Note: Round your intermediate calculations and final answer to decimal places.

Dividend yield ratio.

Note: Round your intermediate calculations and final answer to decimal places.

Book value per share.

Note: Round your answer to decimal places.

table Earnings per share,, Priceearnings ratio,, Dividend payout ratio,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock