Question: Exercise 1 7 - 1 9 ( Static ) Record pension expense, funding, and gains and losses; financial statement effects [ LO 1 7 -

Exercise Static Record pension expense, funding, and gains and losses; financial statement effects LO

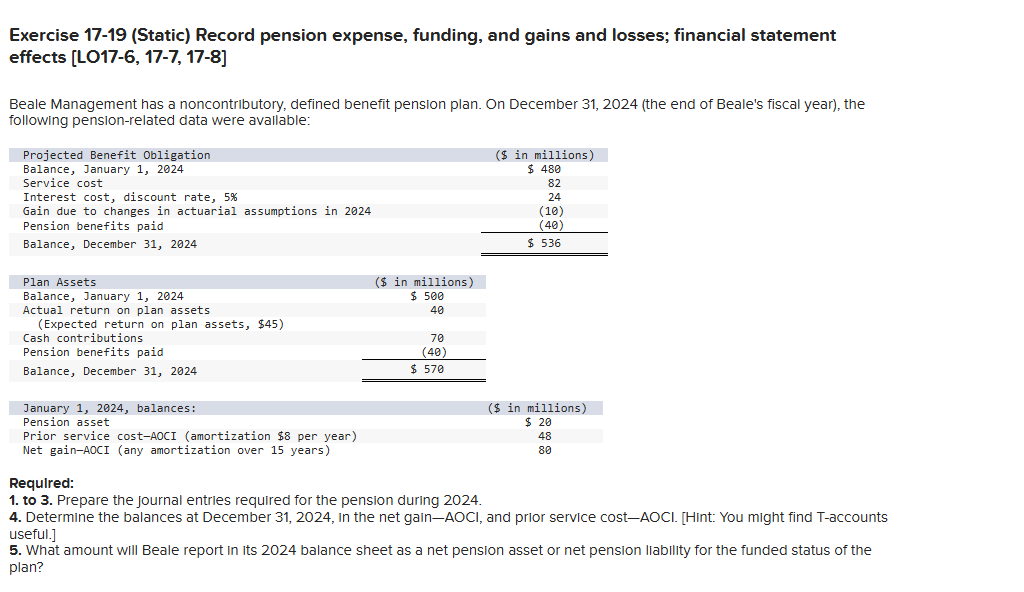

Beale Management has a noncontributory, defined benefit pension plan. On December the end of Beale's fiscal year the following pensionrelated data were avallable:

Required:

to Prepare the journal entries required for the pension during

Determine the balances at December in the net gainAOCl, and prior service costAOCl. Hint: You might find Taccounts useful.

What amount will Beale report in its balance sheet as a net pension asset or net pension liability for the funded status of the plan? Record the pension expense.

Record the gain on PBO.

Record the loss on plan assets.

Record the funding of plan assets.

Record the payment of benefits.

Net gainAOCl

Prior service costAOCl Req

What amount will Beale report in its balance sheet as a net pension asset or net pension liability for the funded status of the plan?

Note: Enter your answers in millions. ie should be entered as

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock