Question: Exercise 1 7 - 2 4 ( Algorithmic ) ( LO . 3 ) Jacob purchased business equipment for $ 6 3 , 9 0

Exercise AlgorithmicLO

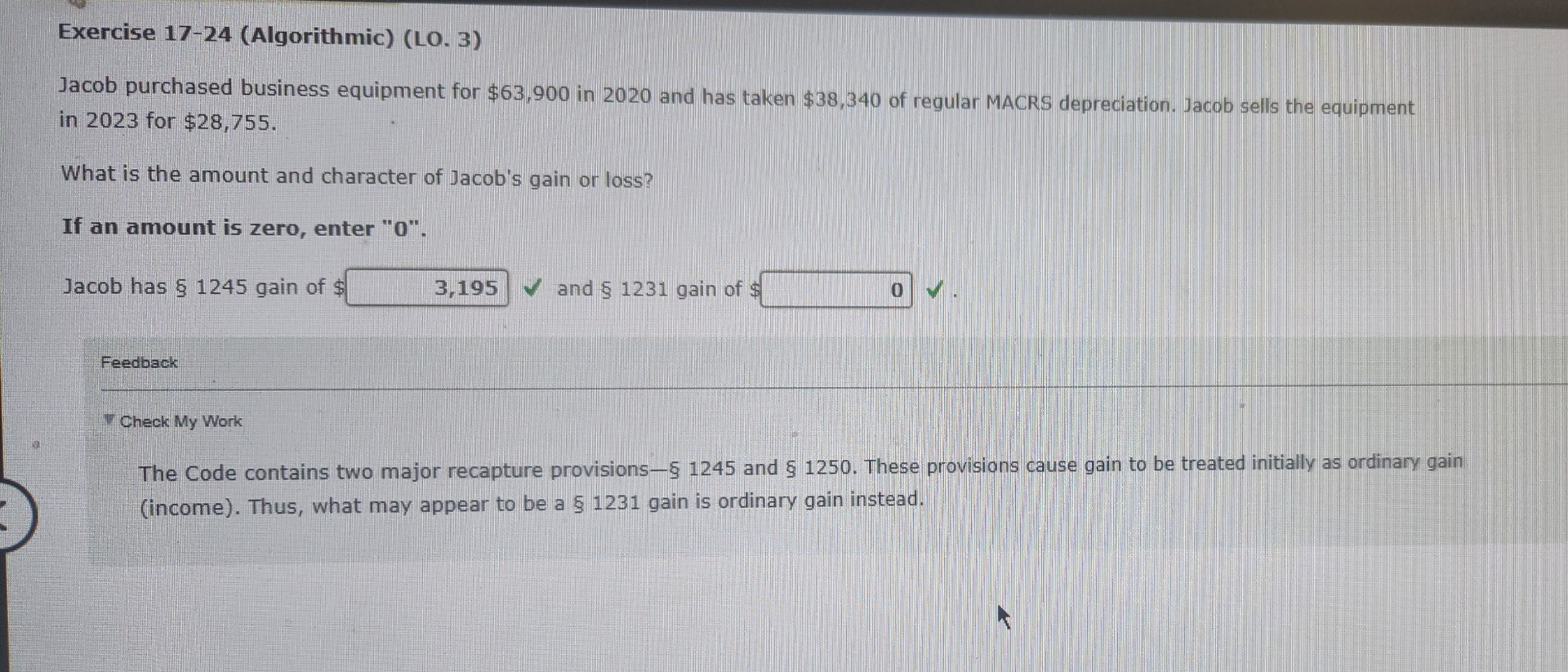

Jacob purchased business equipment for $ in and has taken $ of regular MACRS depreciation. Jacob sells the equipment in for $

What is the amount and character of Jacob's gain or loss?

If an amount is zero, enter

Jacob has gain of $ and gain of $

Feedback

Check My Work

The Code contains two major recapture provisions and These provisions cause gain to be treated initially as ordinary gain income Thus, what may appear to be a gain is ordinary gain instead. why is this and not

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock