Question: Exercise 1 8 - 4 6 Recording and Reporting Temporary Difference Hint: See Demo 1 8 - 1 Exercise 1 8 - 4 7 Recording

Exercise

Recording and Reporting

Temporary Difference

Hint: See Demo

Exercise

Recording and Reporting

Temporary Difference

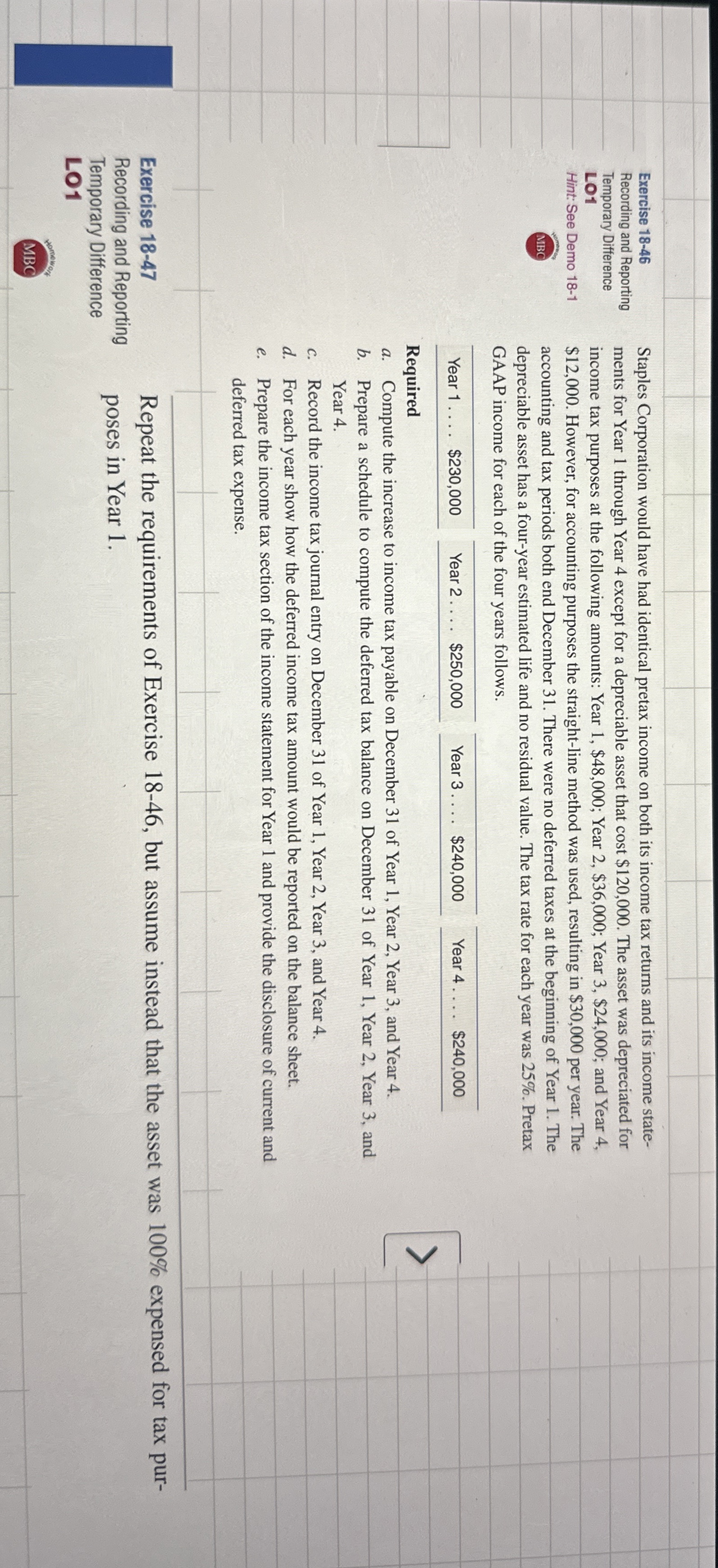

Staples Corporation would have had identical pretax income on both its income tax returns and its income state

ments for Year through Year except for a depreciable asset that cost $ The asset was depreciated for

income tax purposes at the following amounts: Year $; Year $; Year $; and Year

$ However, for accounting purposes the straightline method was used, resulting in $ per year. The

accounting and tax periods both end December There were no deferred taxes at the beginning of Year The

depreciable asset has a fouryear estimated life and no residual value. The tax rate for each year was Pretax

GAAP income for each of the four years follows.

Year dots.

Year $

Year

$

Required

a Compute the increase to income tax payable on December of Year Year Year and Year

b Prepare a schedule to compute the deferred tax balance on December of Year Year Year and

Year

c Record the income tax journal entry on December of Year Year Year and Year

d For each year show how the deferred income tax amount would be reported on the balance sheet.

e Prepare the income tax section of the income statement for Year and provide the disclosure of current and

deferred tax expense.

Repeat the requirements of Exercise but assume instead that the asset was expensed for tax pur

poses in Year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock