Question: Exercise 1 9 - 2 4 ( Algorithmic ) ( LO . 8 ) Right before his death from a terminal illness, Shing makes a

Exercise AlgorithmicLO

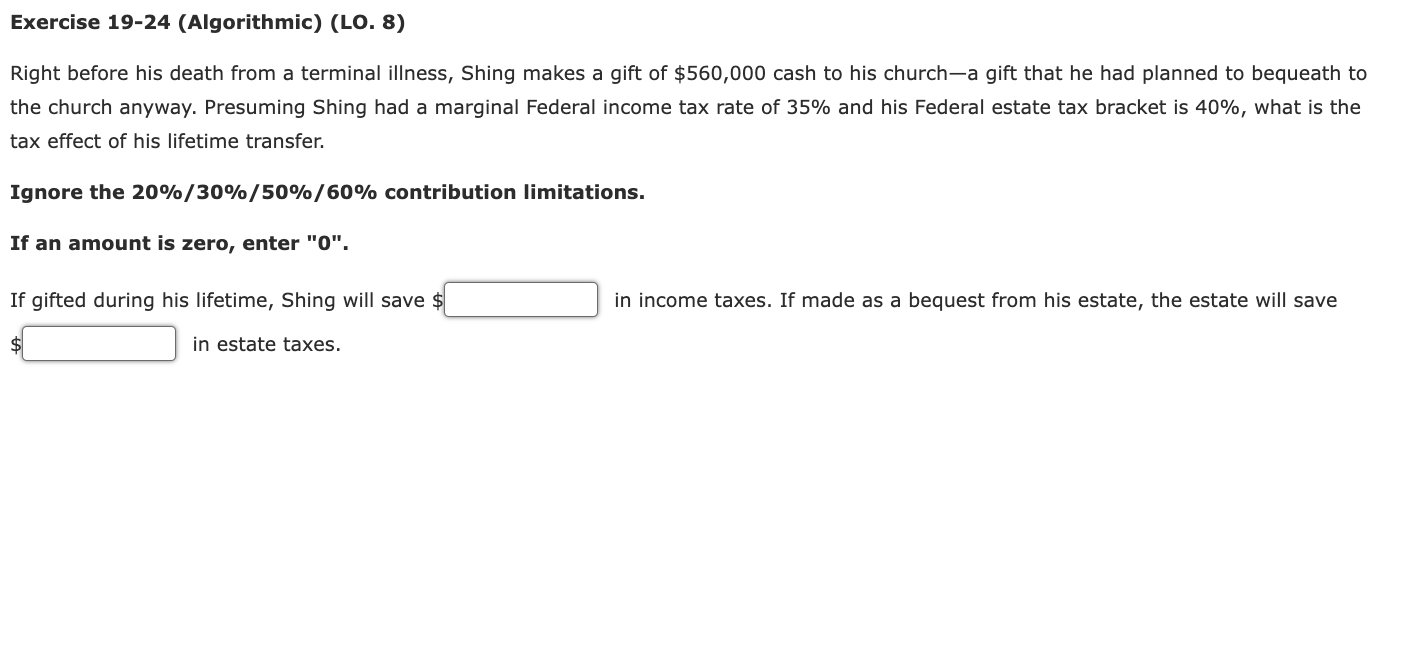

Right before his death from a terminal illness, Shing makes a gift of $ cash to his churcha gift that he had planned to bequeath to

the church anyway. Presuming Shing had a marginal Federal income tax rate of and his Federal estate tax bracket is what is the

tax effect of his lifetime transfer.

Ignore the contribution limitations

If an amount is zero, enter

If gifted during his lifetime, Shing will save $

in income taxes. If made as a bequest from his estate, the estate will save

$

in estate taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock