Question: Exercise 1 9 - 3 Computing the value of an interest rate swap ( LO 1 9 - 1 , LO 1 9 - 2

Exercise Computing the value of an interest rate swap LO LO

On January X Novak, Inc., enters into an interest rate swap and agrees to receive fixed and pay variable on a notional amount of $ The contract calls for cash settlement of the net interest amount at December of each year. The yield curve is flat, and the agreement is to last until December X Both the fixed annual rate and the variable annual rate at January X are The variable interest rate is reset at the end of each year and becomes effective for the next year. On December X the variable rate is reset to per year, and on December times the variable rate is reset to

Required:

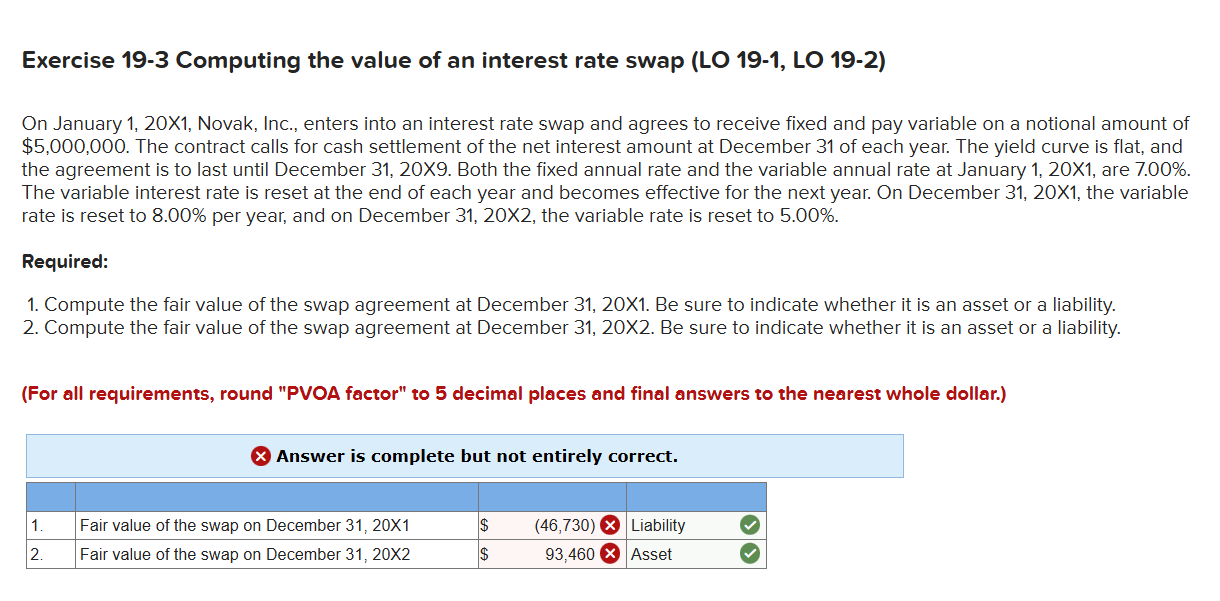

Compute the fair value of the swap agreement at December times Be sure to indicate whether it is an asset or a liability.

Compute the fair value of the swap agreement at December X Be sure to indicate whether it is an asset or a liability.

For all requirements, round "PVOA factor" to decimal places and final answers to the nearest whole dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock