Question: exercise 1 and exercise 2 thank you Exercise One On July 1, 2022, Phillips Inc. Invested $480,000 in a mine estimated to have 800,000 tonnes

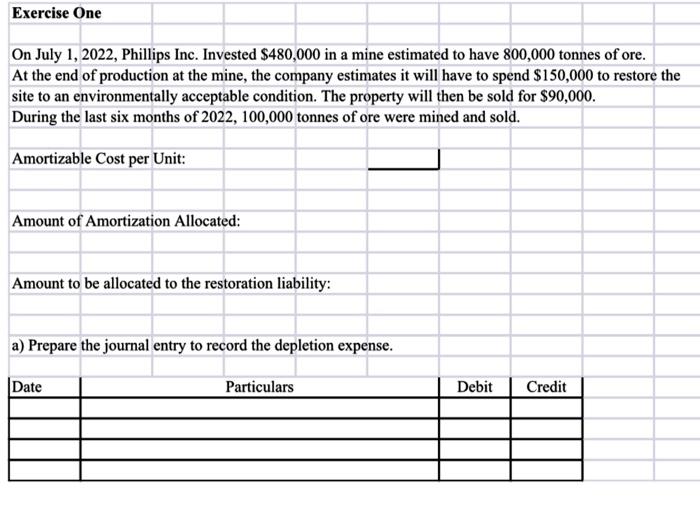

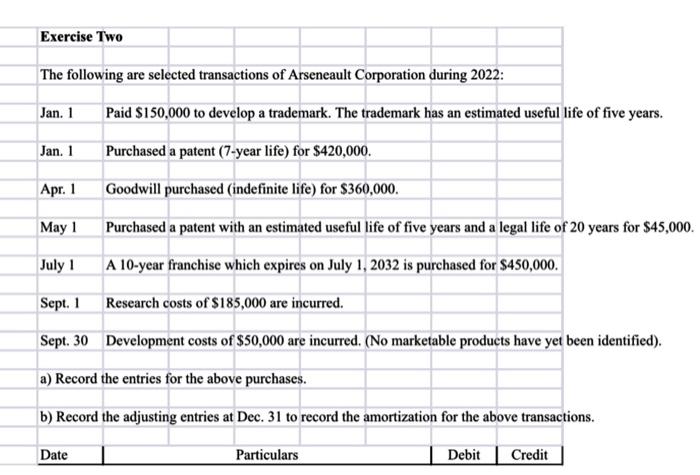

Exercise One On July 1, 2022, Phillips Inc. Invested $480,000 in a mine estimated to have 800,000 tonnes of ore. At the end of production at the mine, the company estimates it will have to spend $150,000 to restore the site to an environmentally acceptable condition. The property will then be sold for $90,000. During the last six months of 2022, 100,000 tonnes of ore were mined and sold. Amortizable Cost per Unit: Amount of Amortization Allocated: Amount to be allocated to the restoration liability: a) Prepare the journal entry to record the depletion expense. Date Particulars Debit Credit Exercise Two The following are selected transactions of Arseneault Corporation during 2022: Jan. 1 Paid $150,000 to develop a trademark. The trademark has an estimated useful life of five years. Jan. 1 Purchased a patent (7-year life) for $420,000. Apr. 1 Goodwill purchased (indefinite life) for $360,000. May 1 Purchased a patent with an estimated useful life of five years and a legal life of 20 years for $45,000. A 10-year franchise which expires on July 1, 2032 is purchased for $450,000. July 1 Sept. 1 Research costs of $185,000 are incurred. Sept. 30 Development costs of $50,000 are incurred. (No marketable products have yet been identified). a) Record the entries for the above purchases. b) Record the adjusting entries at Dec. 31 to record the amortization for the above transactions. Date Particulars Debit Credit Exercise One On July 1, 2022, Phillips Inc. Invested $480,000 in a mine estimated to have 800,000 tonnes of ore. At the end of production at the mine, the company estimates it will have to spend $150,000 to restore the site to an environmentally acceptable condition. The property will then be sold for $90,000. During the last six months of 2022, 100,000 tonnes of ore were mined and sold. Amortizable Cost per Unit: Amount of Amortization Allocated: Amount to be allocated to the restoration liability: a) Prepare the journal entry to record the depletion expense. Date Particulars Debit Credit Exercise Two The following are selected transactions of Arseneault Corporation during 2022: Jan. 1 Paid $150,000 to develop a trademark. The trademark has an estimated useful life of five years. Jan. 1 Purchased a patent (7-year life) for $420,000. Apr. 1 Goodwill purchased (indefinite life) for $360,000. May 1 Purchased a patent with an estimated useful life of five years and a legal life of 20 years for $45,000. A 10-year franchise which expires on July 1, 2032 is purchased for $450,000. July 1 Sept. 1 Research costs of $185,000 are incurred. Sept. 30 Development costs of $50,000 are incurred. (No marketable products have yet been identified). a) Record the entries for the above purchases. b) Record the adjusting entries at Dec. 31 to record the amortization for the above transactions. Date Particulars Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts