Question: EXERCISE 1 Background Using the Dry Supply case study for an example of the loan documentation process and related requirements, suppose that Dry Supply and

EXERCISE

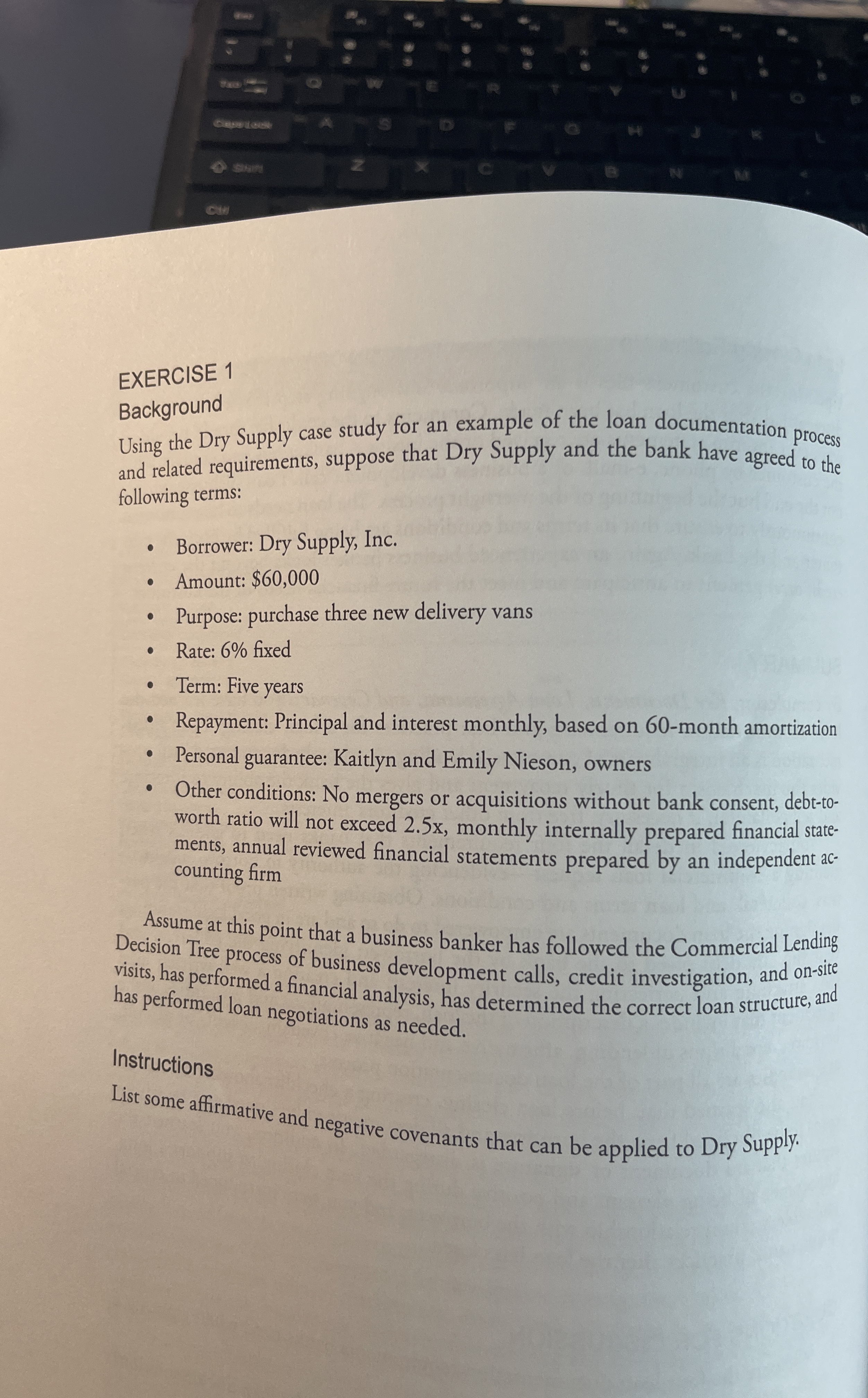

Background

Using the Dry Supply case study for an example of the loan documentation process and related requirements, suppose that Dry Supply and the bank have agreed to the following terms:

Borrower: Dry Supply, Inc.

Amount: $

Purpose: purchase three new delivery vans

Rate: fixed

Term: Five years

Repayment: Principal and interest monthly, based on month amortization

Personal guarantee: Kaitlyn and Emily Nieson, owners

Other conditions: No mergers or acquisitions without bank consent, debttoworth ratio will not exceed x monthly internally prepared financial statements, annual reviewed financial statements prepared by an independent accounting firm

Assume at this point that a business banker has followed the Commercial Lending Decision Tree process of business development calls, credit investigation, and onsite visits, has performed a financial analysis, has determined the correct loan structure, and has performed loan negotiations as needed.

Instructions

List some affirmative and negative covenants that can be applied to Dry Supply.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock