Question: Exercise 1: Basics in Financial Valuation (20 points) Lufthansa AG is comparing the investment into two aircraft projects by referring to financial valuation techniques. The

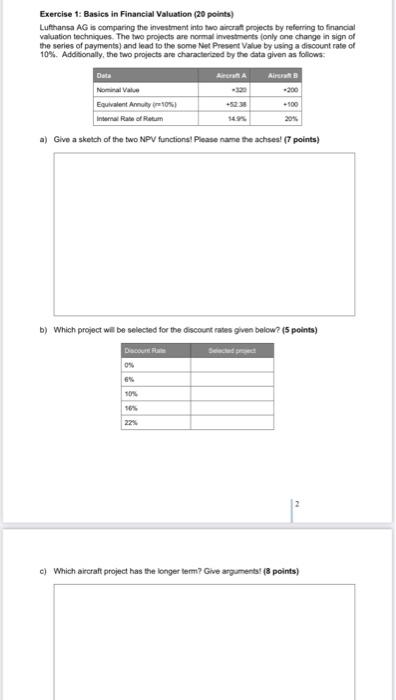

Exercise 1: Basics in Financial Valuation (20 points) Lufthansa AG is comparing the investment into two aircraft projects by referring to financial valuation techniques. The two projects are normal investments only one change in sign of the series of payments) and lead to the some Net Present Value by using a discount rate of 10%. Additionally, the two projects are characterized by the data given as follows: Air Data Nominal Valve Equivalent Amulyo Internal Rate of Retum +100 a) Give a sketch of the two NPV functions! Please name the ches! (7 points) b) Which project will be selected for the discount rates given below ? (5 points) Discount 0% 10 96% 22 c) Which aircraft project has the longer term? Give arguments! (points) Exercise 1: Basics in Financial Valuation (20 points) Lufthansa AG is comparing the investment into two aircraft projects by referring to financial valuation techniques. The two projects are normal investments only one change in sign of the series of payments) and lead to the some Net Present Value by using a discount rate of 10%. Additionally, the two projects are characterized by the data given as follows: Air Data Nominal Valve Equivalent Amulyo Internal Rate of Retum +100 a) Give a sketch of the two NPV functions! Please name the ches! (7 points) b) Which project will be selected for the discount rates given below ? (5 points) Discount 0% 10 96% 22 c) Which aircraft project has the longer term? Give arguments! (points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts