Question: Exercise 1 Circle the items below that are representative of traditional ERM frameworks. A. Both aggregate measures - enterprise risk exposure and risk appetite -

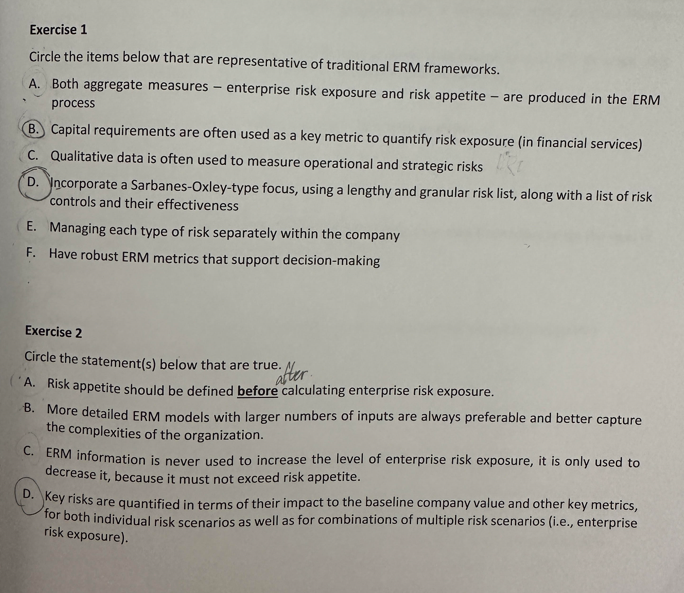

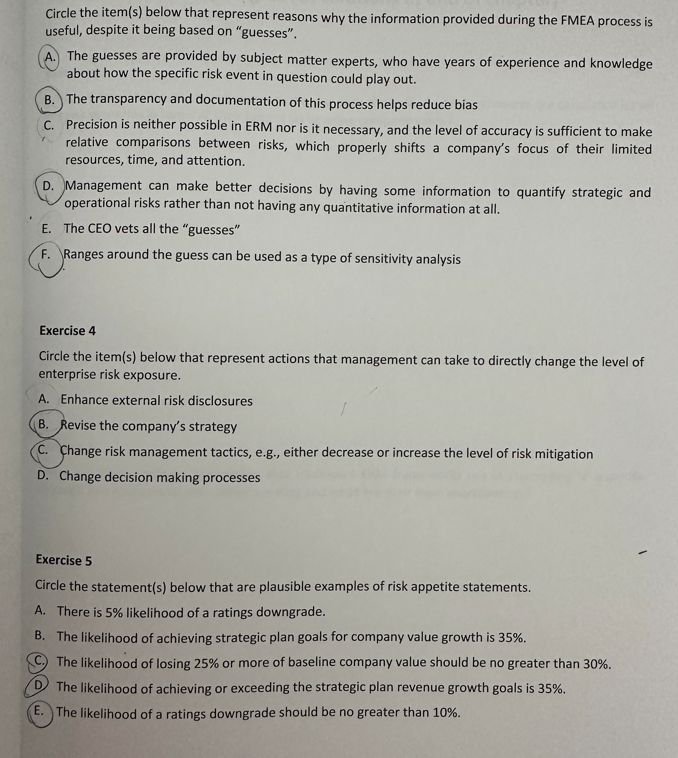

Exercise 1 Circle the items below that are representative of traditional ERM frameworks. A. Both aggregate measures - enterprise risk exposure and risk appetite - are produced in the ERM process B. Capital requirements are often used as a key metric to quantify risk exposure (in financial services) C. Qualitative data is often used to measure operational and strategic risks D. Incorporate a Sarbanes-Oxley-type focus, using a lengthy and granular risk list, along with a list of risk controls and their effectiveness E. Managing each type of risk separately within the company F. Have robust ERM metrics that support decision-making Exercise 2 Circle the statement(s) below that are true. A. Risk appetite should be defined before calculating enterprise risk exposure. B. More detailed ERM models with larger numbers of inputs are always preferable and better capture the complexities of the organization. C. ERM information is never used to increase the level of enterprise risk exposure, it is only used to decrease it, because it must not exceed risk appetite. D. Key risks are quantified in terms of their impact to the baseline company value and other key metrics, for both individual risk scenarios as well as for combinations of multiple risk scenarios (i.e., enterprise risk exposure). Circle the item(s) below that represent reasons why the information provided during the FMEA process is useful, despite it being based on "guesses". A. The guesses are provided by subject matter experts, who have years of experience and knowledge about how the specific risk event in question could play out. B. The transparency and documentation of this process helps reduce bias C. Precision is neither possible in ERM nor is it necessary, and the level of accuracy is sufficient to make relative comparisons between risks, which properly shifts a company's focus of their limited resources, time, and attention. D. Management can make better decisions by having some information to quantify strategic and operational risks rather than not having any quantitative information at all. E. The CEO vets all the "guesses" F. Ranges around the guess can be used as a type of sensitivity analysis Exercise 4 Circle the item(s) below that represent actions that management can take to directly change the level of enterprise risk exposure. A. Enhance external risk disclosures B. Revise the company's strategy C. Change risk management tactics, e.g., either decrease or increase the level of risk mitigation D. Change decision making processes Exercise 5 Circle the statement(s) below that are plausible examples of risk appetite statements. A. There is 5% likelihood of a ratings downgrade. B. The likelihood of achieving strategic plan goals for company value growth is 35%. (C.) The likelihood of losing 25% or more of baseline company value should be no greater than 30%. D The likelihood of achieving or exceeding the strategic plan revenue growth goals is 35%. E. The likelihood of a ratings downgrade should be no greater than 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts