Question: Exercise 1. Consider a situation where you have 2 zero-bonds available. a (n + 1)-periods bond, paying $1 in period n +1, and current price

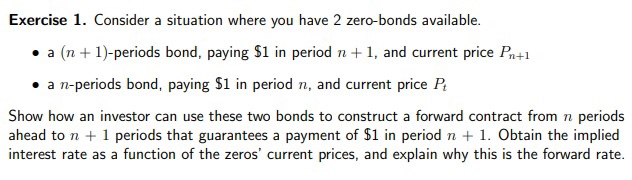

Exercise 1. Consider a situation where you have 2 zero-bonds available. a (n + 1)-periods bond, paying $1 in period n +1, and current price Pn+1 a n-periods bond, paying $1 in period n, and current price P Show how an investor can use these two bonds to construct a forward contract from n periods ahead to n + 1 periods that guarantees a payment of $1 in period n + 1. Obtain the implied interest rate as a function of the zeros' current prices, and explain why this is the forward rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock