Question: Exercise 1. (Do this problem by hand. Don't just put it in a program like Excel. I want to see your work.) Bond A is

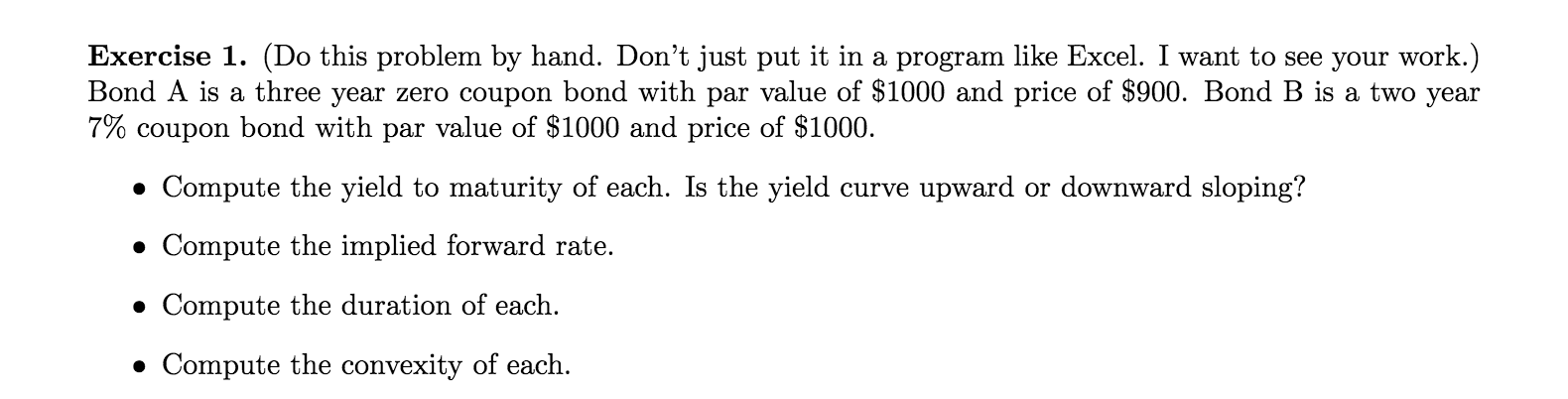

Exercise 1. (Do this problem by hand. Don't just put it in a program like Excel. I want to see your work.) Bond A is a three year zero coupon bond with par value of $1000 and price of $900. Bond B is a two year 7% coupon bond with par value of $1000 and price of $1000. Compute the yield to maturity of each. Is the yield curve upward or downward sloping? Compute the implied forward rate. Compute the duration of each. Compute the convexity of each

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts