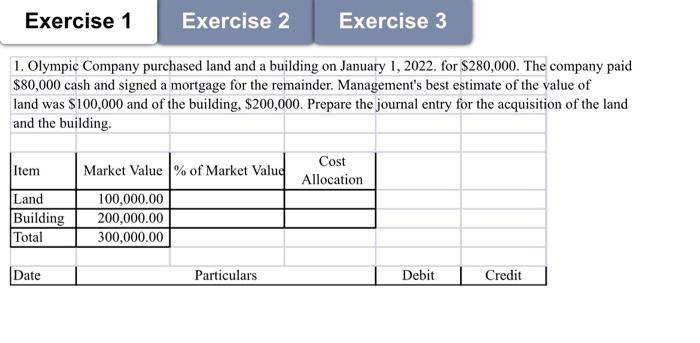

Question: exercise 1, exercise 2, and exercise 3 Exercise 1 Exercise 2 Exercise 3 1. Olympic Company purchased land and a building on January 1, 2022.

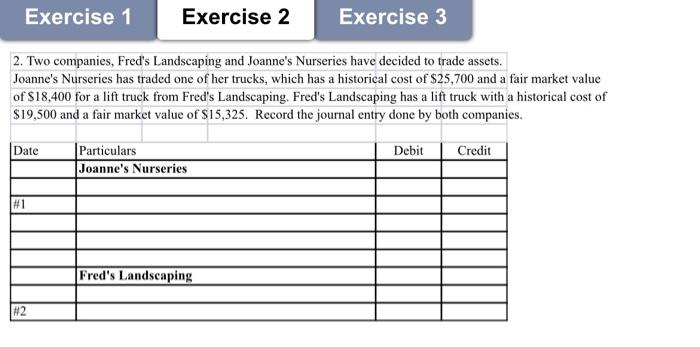

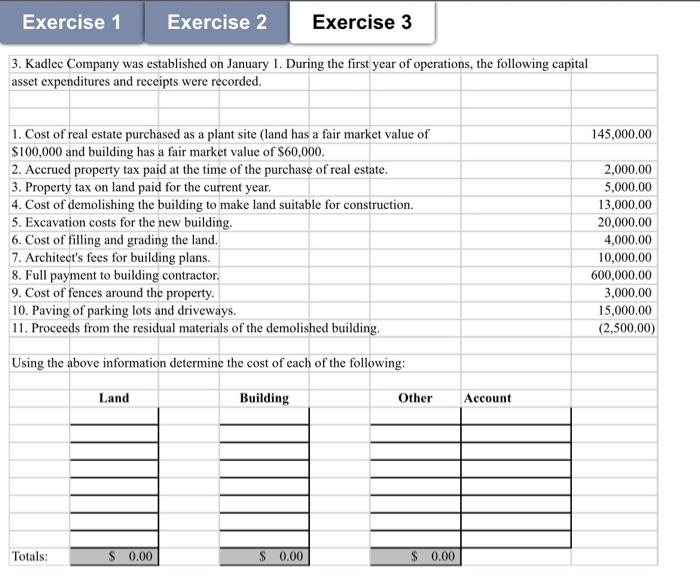

Exercise 1 Exercise 2 Exercise 3 1. Olympic Company purchased land and a building on January 1, 2022. for $280,000. The company paid $80,000 cash and signed a mortgage for the remainder. Management's best estimate of the value of land was $100,000 and of the building, $200,000. Prepare the journal entry for the acquisition of the land and the building. Item Market Value % of Market Value Cost Allocation Land Building Total 100,000.00 200,000.00 300,000.00 Date Particulars Debit | Credit Exercise 1 Exercise 2 Exercise 3 2. Two companies, Fred's Landscaping and Joanne's Nurseries have decided to trade assets. Joanne's Nurseries has traded one of her trucks, which has a historical cost of $25,700 and a fair market value of $18,400 for a lift truck from Fred's Landscaping. Fred's Landscaping has a lift truck with a historical cost of $19,500 and a fair market value of $15,325. Record the journal entry done by both companies, Date Debit Credit Particulars Joanne's Nurseries #1 Fred's Landscaping #2 Exercise 1 Exercise 2 Exercise 3 3. Kadlec Company was established on January 1. During the first year of operations, the following capital asset expenditures and receipts were recorded. 145,000.00 1. Cost of real estate purchased as a plant site (land has a fair market value of $100,000 and building has a fair market value of $60,000. 2. Accrued property tax paid at the time of the purchase of real estate. 3. Property tax on land paid for the current year. 4. Cost of demolishing the building to make land suitable for construction. 5. Excavation costs for the new building. 6. Cost of filling and grading the land. 7. Architect's fees for building plans. 8. Full payment to building contractor. 9. Cost of fences around the property. 10. Paving of parking lots and driveways. 11. Proceeds from the residual materials of the demolished building. 2,000.00 5,000.00 13,000.00 20,000.00 4,000.00 10,000.00 600,000.00 3,000.00 15,000.00 (2,500,00) Using the above information determine the cost of each of the following: Land Building Other Account Totals: $ 0.00 $ 0.00 $ 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts