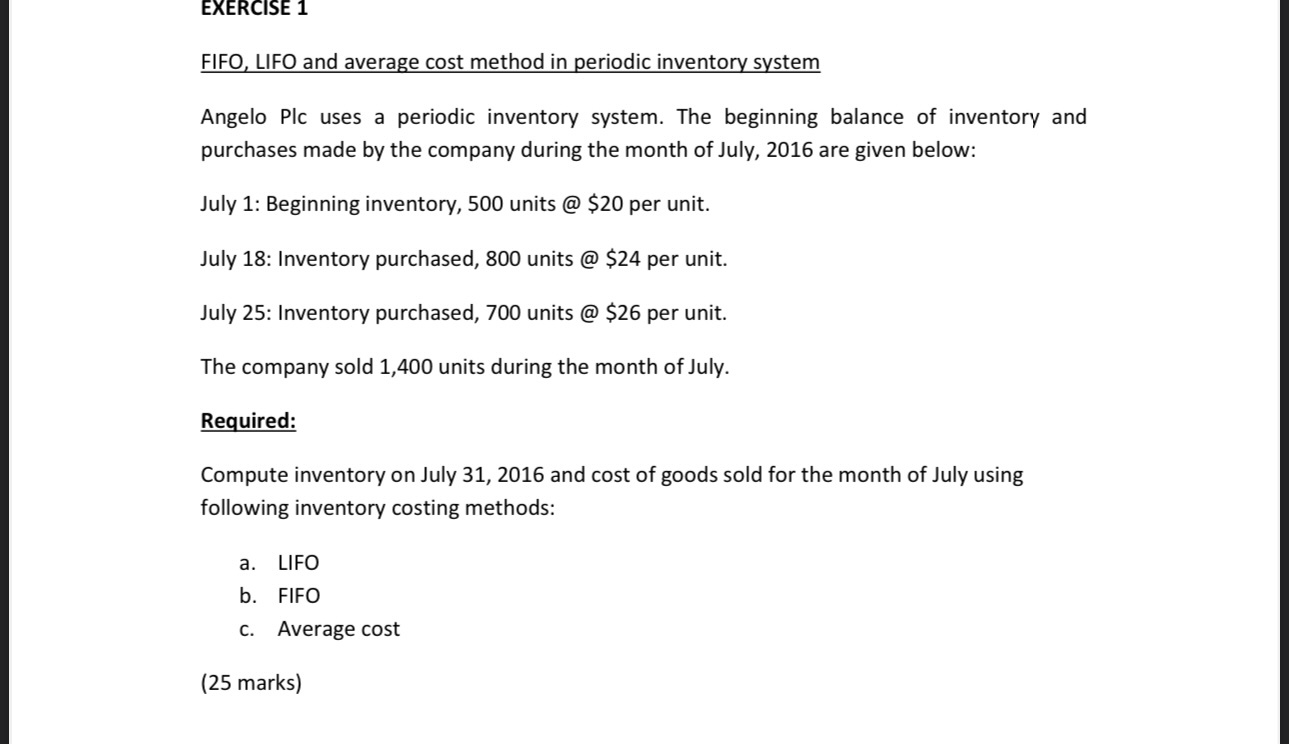

Question: EXERCISE 1 FIFO, LIFO and average cost method in periodic inventory system Angelo Pic uses a periodic inventory system. The beginning balance of inventory and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts