Question: Exercise 1 - Financial Analysis I Suppose Tom has made the following costs and benefits estimation for the project: One-time Costs: - Hardware - 200

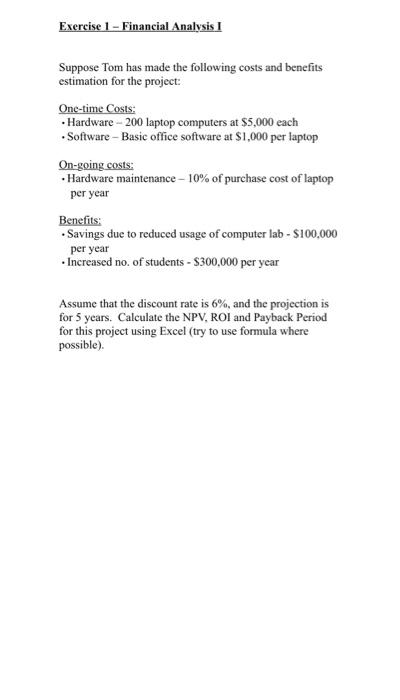

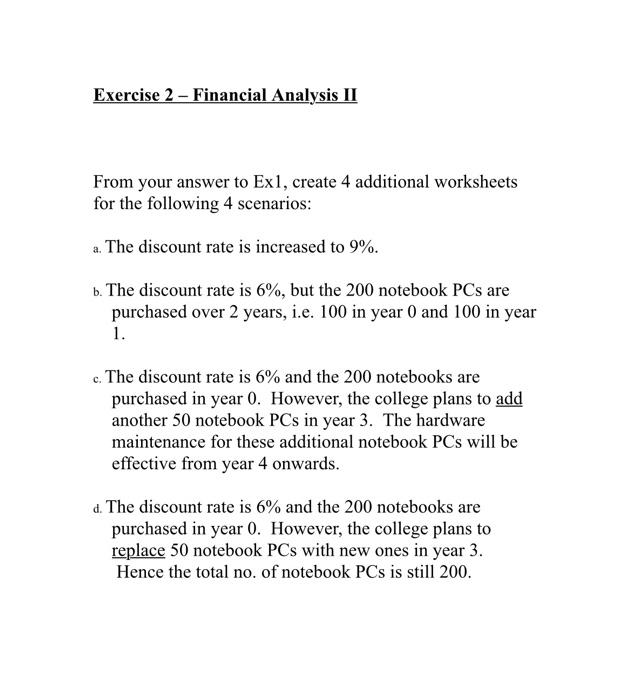

Exercise 1 - Financial Analysis I Suppose Tom has made the following costs and benefits estimation for the project: One-time Costs: - Hardware - 200 laptop computers at $5,000 each - Software - Basic office software at $1,000 per laptop On-going costs: - Hardware maintenance - 10% of purchase cost of laptop per year Benefits: - Savings due to reduced usage of computer lab - $100,000 per year - Increased no. of students - $300,000 per year Assume that the discount rate is 6%, and the projection is for 5 years. Calculate the NPV, ROI and Payback Period for this project using Excel (try to use formula where possible). Exercise 2 - Financial Analysis II From your answer to Ex1, create 4 additional worksheets for the following 4 scenarios: a. The discount rate is increased to 9%. b. The discount rate is 6%, but the 200 notebook PCs are purchased over 2 years, i.e. 100 in year 0 and 100 in year 1. c. The discount rate is 6% and the 200 notebooks are purchased in year 0 . However, the college plans to add another 50 notebook PCs in year 3 . The hardware maintenance for these additional notebook PCs will be effective from year 4 onwards. d. The discount rate is 6% and the 200 notebooks are purchased in year 0 . However, the college plans to replace 50 notebook PCs with new ones in year 3 . Hence the total no. of notebook PCs is still 200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts