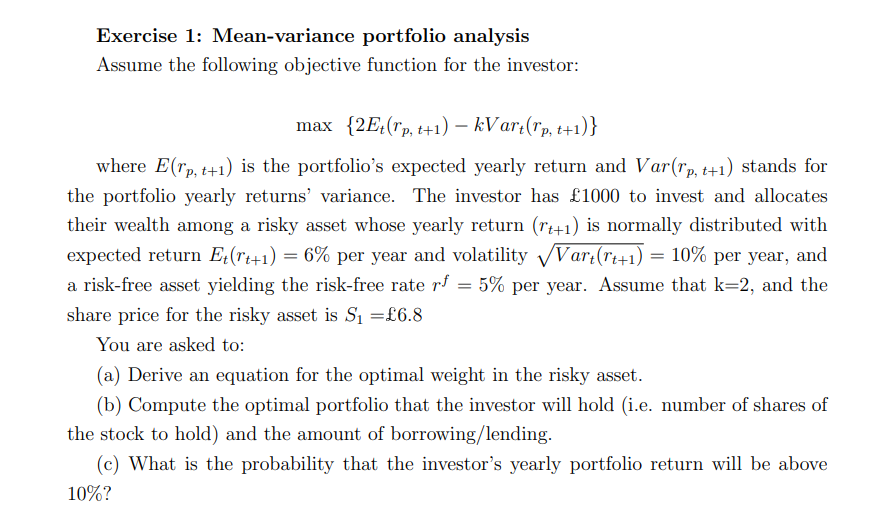

Question: Exercise 1 : Mean - variance portfolio analysis Assume the following objective function for the investor: max { 2 E t ( r p ,

Exercise : Meanvariance portfolio analysis

Assume the following objective function for the investor:

max

where is the portfolio's expected yearly return and Var stands for

the portfolio yearly returns' variance. The investor has to invest and allocates

their wealth among a risky asset whose yearly return is normally distributed with

expected return per year and volatility per year, and

a riskfree asset yielding the riskfree rate per year. Assume that and the

share price for the risky asset is

You are asked to:

a Derive an equation for the optimal weight in the risky asset.

b Compute the optimal portfolio that the investor will hold ie number of shares of

the stock to hold and the amount of borrowinglending

c What is the probability that the investor's yearly portfolio return will be above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock