Question: Exercise 1 : Part A: Given the following foreign exchange rates: a . Determine the outright forward rate for each maturity b . Determine the

Exercise :

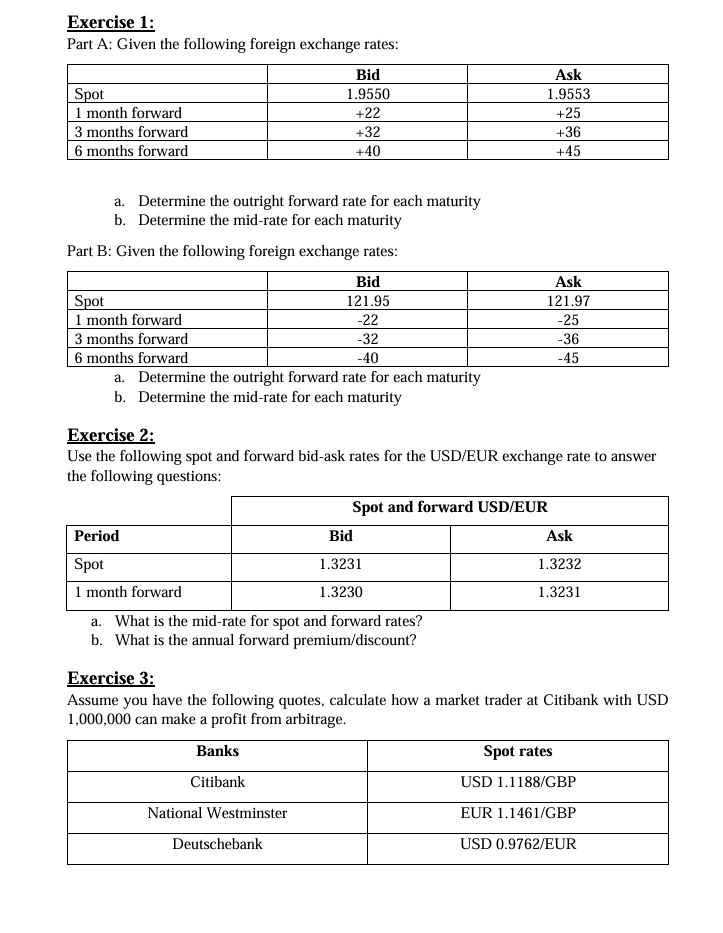

Part A: Given the following foreign exchange rates:

a Determine the outright forward rate for each maturity

b Determine the midrate for each maturity

Part B: Given the following foreign exchange rates:

a Determine the outright forward rate for each maturity

b Determine the midrate for each maturity

Exercise :

Use the following spot and forward bidask rates for the USDEUR exchange rate to answer the following questions:

a What is the midrate for spot and forward rates?

b What is the annual forward premiumdiscount

Exercise :

Assume you have the following quotes, calculate how a market trader at Citibank with USD can make a profit from arbitrage. Exercise :

Part A: Given the following foreign exchange rates:

a Determine the outright forward rate for each maturity

b Determine the midrate for each maturity

Part B: Given the following foreign exchange rates:

a Determine the outright forward rate for each maturity

b Determine the midrate for each maturity

Exercise :

Use the following spot and forward bidask rates for the USDEUR exchange rate to answer the following questions:

a What is the midrate for spot and forward rates?

b What is the annual forward premiumdiscount

Exercise :

Assume you have the following quotes, calculate how a market trader at Citibank with USD can make a profit from arbitrage. Exercise :

The following exchange rates are available to you. You can buy or sell at the stated rates. Assume you have an initial SF Can you make a profit via triangular arbitrage? If so show the steps and calculate the amount of profit in Swiss francs Swissies

Mt Fuji Bank $

Mt Rushmore Bank SF$

Mt Blanc Bank SF

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock