Question: exercise 1 questions a and b please Exercise One R. Huma and W. How have capital balances on June 30, 2022 of $50,000 and $40,000,

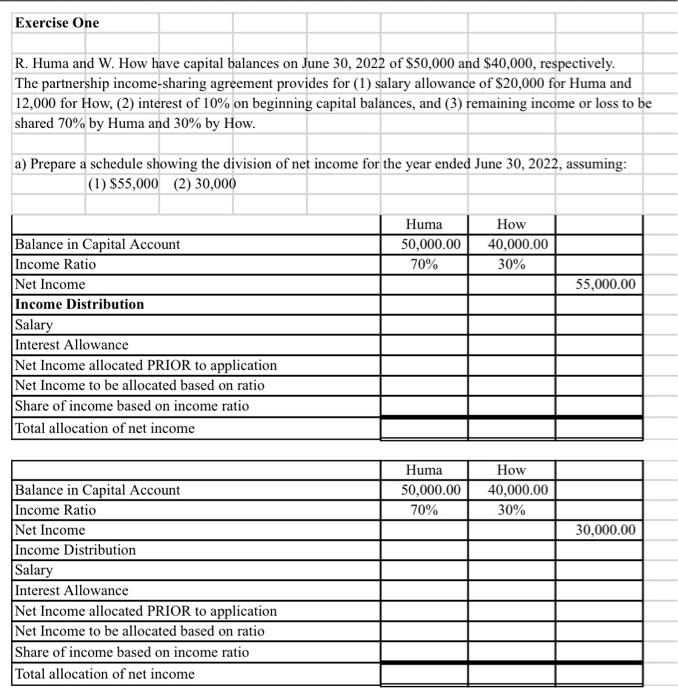

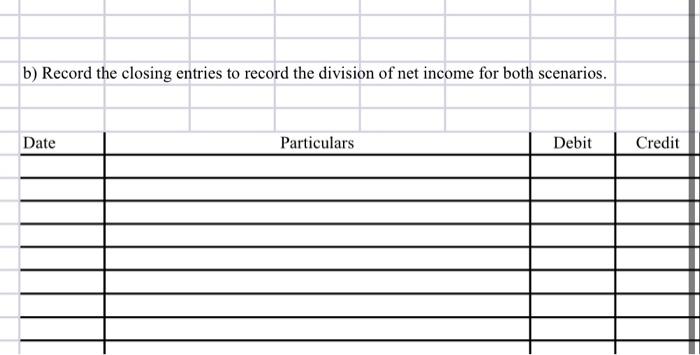

Exercise One R. Huma and W. How have capital balances on June 30, 2022 of $50,000 and $40,000, respectively. The partnership income-sharing agreement provides for (1) salary allowance of $20,000 for Huma and 12,000 for How, (2) interest of 10% on beginning capital balances, and (3) remaining income or loss to be shared 70% by Huma and 30% by How. a) Prepare a schedule showing the division of net income for the year ended June 30, 2022, assuming: (1) $55,000 (2) 30,000 Balance in Capital Account Huma 50,000.00 70% How 40,000.00 30% Income Ratio Net Income 55,000.00 Income Distribution Salary Interest Allowance Net Income allocated PRIOR to application Net Income to be allocated based on ratio Share of income based on income ratio Total allocation of net income Balance in Capital Account Huma 50,000.00 70% How 40,000.00 30% Income Ratio Net Income Income Distribution Salary Interest Allowance Net Income allocated PRIOR to application Net Income to be allocated based on ratio Share of income based on income ratio Total allocation of net income 30,000.00 b) Record the closing entries to record the division of net income for both scenarios. Date Particulars Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts