Question: Exercise 1. Suppose the only three risky assets in the market have the following vector of expected returns and the following variance-covariance matrix: Er1) E(r2)

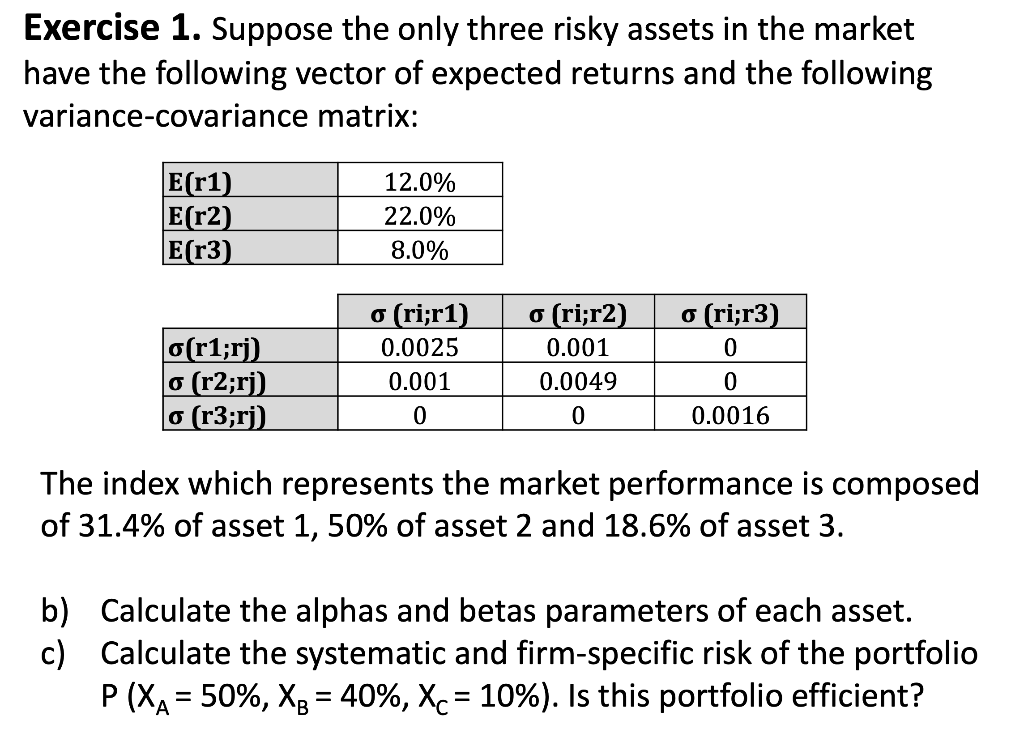

Exercise 1. Suppose the only three risky assets in the market have the following vector of expected returns and the following variance-covariance matrix: Er1) E(r2) E[r3) 12.0% 22.0% 8.0% o(r1;rj) o (r2;ri) o (r3;rj) o (ri;r1) 0.0025 0.001 0 o (ri;r2) 0.001 0.0049 0 o (ri;r3) 0 0 0.0016 The index which represents the market performance is composed of 31.4% of asset 1, 50% of asset 2 and 18.6% of asset 3. b) Calculate the alphas and betas parameters of each asset. c) Calculate the systematic and firm-specific risk of the portfolio P (XA = 50%, X3 = 40%, Xc = 10%). Is this portfolio efficient? - = Exercise 1. Suppose the only three risky assets in the market have the following vector of expected returns and the following variance-covariance matrix: Er1) E(r2) E[r3) 12.0% 22.0% 8.0% o(r1;rj) o (r2;ri) o (r3;rj) o (ri;r1) 0.0025 0.001 0 o (ri;r2) 0.001 0.0049 0 o (ri;r3) 0 0 0.0016 The index which represents the market performance is composed of 31.4% of asset 1, 50% of asset 2 and 18.6% of asset 3. b) Calculate the alphas and betas parameters of each asset. c) Calculate the systematic and firm-specific risk of the portfolio P (XA = 50%, X3 = 40%, Xc = 10%). Is this portfolio efficient? - =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts