Question: Exercise 1 Tented plc. has developed a new tent which had rave reviews in the camping press. The company paid a dividend of 0.1 per

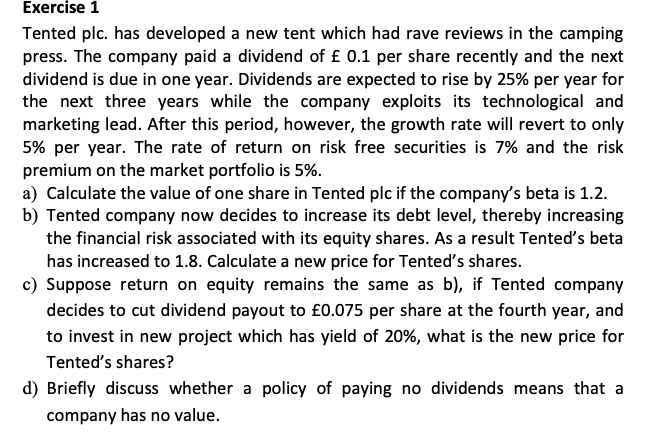

Exercise 1 Tented plc. has developed a new tent which had rave reviews in the camping press. The company paid a dividend of 0.1 per share recently and the next dividend is due in one year. Dividends are expected to rise by 25% per year for the next three years while the company exploits its technological and marketing lead. After this period, however, the growth rate will revert to only 5% per year. The rate of return on risk free securities is 7% and the risk premium on the market portfolio is 5%. a) Calculate the value of one share in Tented plc if the company's beta is 1.2. b) Tented company now decides to increase its debt level, thereby increasing the financial risk associated with its equity shares. As a result Tented's beta has increased to 1.8. Calculate a new price for Tented's shares. c) Suppose return on equity remains the same as b), if Tented company decides to cut dividend payout to 0.075 per share at the fourth year, and to invest in new project which has yield of 20%, what is the new price for Tented's shares? d) Briefly discuss whether a policy of paying no dividends means that a company has no value

Step by Step Solution

There are 3 Steps involved in it

a Calculate the value of one share in Tented plc if the companys beta is 12 Step 1 Calculate the required rate of return using CAPM The Capital Asset Pricing Model CAPM formula is R Rf beta times Rm R... View full answer

Get step-by-step solutions from verified subject matter experts