Question: Exercise 1: This exercise studies the diversification of default risk for corporate loans. A financial insti tution has 200,000 AUD for investment. There are 2

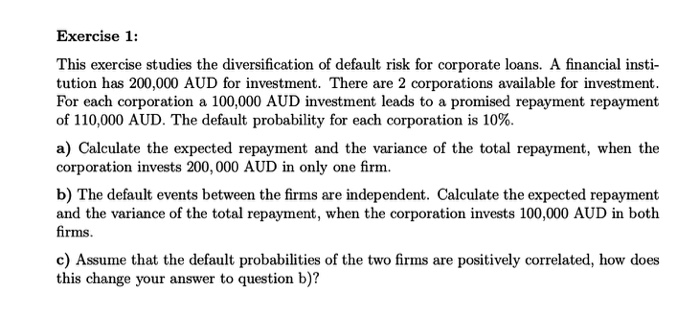

Exercise 1: This exercise studies the diversification of default risk for corporate loans. A financial insti tution has 200,000 AUD for investment. There are 2 corporations available for investment For each corporation a 100,000 AUD investment leads to a promised repayment repayment of 110,000 AUD. The default probability for each corporation is 10%. a) Calculate the expected repayment and the variance of the total repayment, when the corporation invests 200,000 AUD in only one firm. b) The default events between the firms are independent. Calculate the expected repayment and the variance of the total repayment, when the corporation invests 100,000 AUD in botlh firms. c) Assume that the default probabilities of the two firms are positively correlated, how does this change your answer to question b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts