Question: Exercise 1: Use the above information and try to answer the following: Assume you are the investor who wants to invest in a two stock/security

Exercise 1:

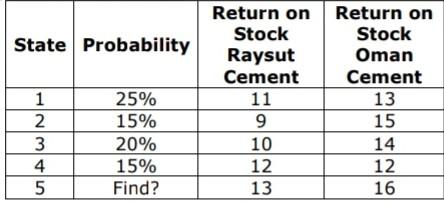

Use the above information and try to answer the following: Assume you are the investor who wants to invest in a two stock/security portfolio made from the above stocks of your choice? a) Find the expected return of your portfolio formed from the two stocks AND you will decide their weights in the portfolio. b) Calculate your returns from the portfolio assuming you invest OMR 10000 c) Find the Covariance and correlation coefficient for your portfolio d) Justify as to on what basis did you choose these stocks and how did you decide the weights? e) Explain how will the current situation of pandemic Covid-19, effect the company profitability, fixed cost, variable cost and EBIT? Suggest ways to overcome it?

State Probability 1 2 3 4 5 25% 15% 20% 15% Find? Return on Stock Raysut Cement 11 9 10 12 13 Return on Stock Oman Cement 13 15 14 12 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts