Question: Exercise 1 Using the information provided in Figure 8. Calculate the price-weighted index for the month of July for these companies. What adjustment is required

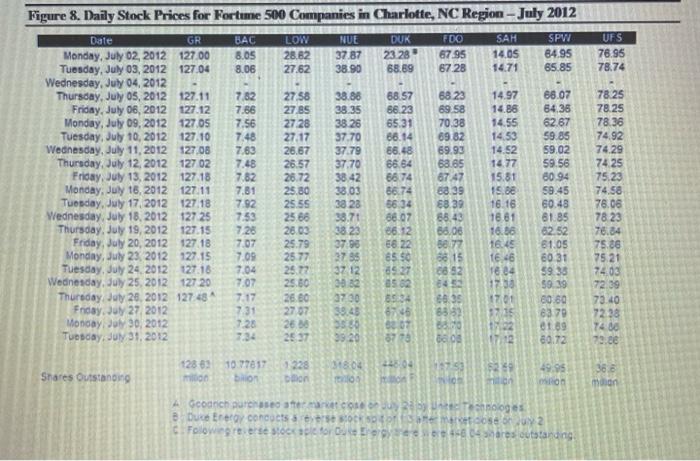

Exercise 1 Using the information provided in Figure 8. Calculate the price-weighted index for the month of July for these companies. What adjustment is required for the Duke Energy 1:3 reverse stock split? How did you account for the removal of Goodrich from the index? Exercise 2 What is the overall change in index value for the month of July using the price- weighted index? Which stock increased in value the most? Which declined the most? Which company(ies) appear to be influencing the price-weighted index the most? Exercise 3 Using the information provided in Figure 8. Calculate the market-weighted index for the month of July for these companies. What adjustment is required for the Duke Energy 1:3 reverse stock split? How did you account for the removal of Goodrich from the index? Exercise 4 What is the overall change in index value for the month of July using the market- weighted index? Which market capitalization increased in value the most? Which declined the most? Which company(ies) appear to be influencing the price-weighted index the most? Exercise 5 Given the information from Exercises 1-4, which method should Brooks suggest that his manager use in her presentation to clients? Why? UFS 76.95 78.74 Figure 8. Daily Stock Prices for Fortune 500 Companies in Charlotte, NC Region - July 2012 Date GR BAC LOW NUE DUK FDO SAH SPW Monday, July 02, 2012 127.00 8.05 28.82 3787 23.28 67.95 14.05 64.95 Tuesday, July 03, 2012 127.04 8.06 27.62 38.90 68.69 6728 1471 65.85 Wednesday, July 04, 2012 Thursday, July 05, 2012 127.11 7.82 27.58 38.88 68.57 68 23 14.97 68.07 Friday, July 06, 2012 127.12 7.56 27 BS 38.35 66.23 69 58 14.88 64.36 Monday, July 09, 2012 127.05 7.56 27 28 38.26 65.31 70.38 14.55 62.67 Tuesday, July 10, 2012 127.10 7.48 27.17 37.70 88.14 69 82 14.53 59.85 Wednesday, July 11, 2012 127.08 7.63 26.67 37.79 86.48 69.93 14.52 59.02 Thursday, July 12, 2012 127 02 7.48 26.57 37.70 86.64 68.65 14.77 59.56 Friday, Juy 13, 2012 127.18 7.82 26.72 38 42 66.74 87 47 15.81 80.94 Monday, July 16, 2012 127.11 7.31 25.80 38.03 86.74 38 39 15.se 59.45 Tuesday, July 17, 2012 127 18 7.92 25.55 38 28 56 34 8.39 16.16 60.48 Wednesday, July 18, 2012 127 25 25.80 38.71 6607 85.43 1861 61.85 Thursday, July 19, 2012 127.15 7.28 26.03 38 23 26.12 88.06 16.06 82.52 Friday, July 20, 2012 127 18 7.07 25.79 37.90 66.22 38.77 16:45 81.05 Monday, July 23, 2012 127.15 7.09 25 77 3795 65.50 8815 16.6 80 31 Tuesday, July 24, 2012 127.18 7.04 25.72 3712 6527 Te 24 59.36 Wednesday, July 25, 2012 127 20 7.07 25.60 08.82 352 245 17230 59.39 Thursday, July 20, 2012 127 48 7.17 26.00 3730 853 86.35 1701 60.60 Friday, Juy 27 2012 731 27.07 39.45 8746 8837 6370 Monday, July 30, 2012 728 26.00 35 36 83.07 38.00 2 1.09 Tuesday, July 31, 2012 7.34 25 37 39 20 873 da o 07.12 80.72 7.53 78.25 78.25 78.36 74.92 74.29 74 25 75.23 74.58 76.06 78 23 78.84 75.86 75.21 24.03 72.39 73.40 7238 74.00 79.86 892 31804 12.04 128 63 10.77817 bio Shares Outstanong 1228 Don 5259 49.95 OR 38. man Goodrich purchase and co2 Duke Energy Conces : Following tersectory Toges Mert sose UN 2 -604 res outstanding Exercise 1 Using the information provided in Figure 8. Calculate the price-weighted index for the month of July for these companies. What adjustment is required for the Duke Energy 1:3 reverse stock split? How did you account for the removal of Goodrich from the index? Exercise 2 What is the overall change in index value for the month of July using the price- weighted index? Which stock increased in value the most? Which declined the most? Which company(ies) appear to be influencing the price-weighted index the most? Exercise 3 Using the information provided in Figure 8. Calculate the market-weighted index for the month of July for these companies. What adjustment is required for the Duke Energy 1:3 reverse stock split? How did you account for the removal of Goodrich from the index? Exercise 4 What is the overall change in index value for the month of July using the market- weighted index? Which market capitalization increased in value the most? Which declined the most? Which company(ies) appear to be influencing the price-weighted index the most? Exercise 5 Given the information from Exercises 1-4, which method should Brooks suggest that his manager use in her presentation to clients? Why? UFS 76.95 78.74 Figure 8. Daily Stock Prices for Fortune 500 Companies in Charlotte, NC Region - July 2012 Date GR BAC LOW NUE DUK FDO SAH SPW Monday, July 02, 2012 127.00 8.05 28.82 3787 23.28 67.95 14.05 64.95 Tuesday, July 03, 2012 127.04 8.06 27.62 38.90 68.69 6728 1471 65.85 Wednesday, July 04, 2012 Thursday, July 05, 2012 127.11 7.82 27.58 38.88 68.57 68 23 14.97 68.07 Friday, July 06, 2012 127.12 7.56 27 BS 38.35 66.23 69 58 14.88 64.36 Monday, July 09, 2012 127.05 7.56 27 28 38.26 65.31 70.38 14.55 62.67 Tuesday, July 10, 2012 127.10 7.48 27.17 37.70 88.14 69 82 14.53 59.85 Wednesday, July 11, 2012 127.08 7.63 26.67 37.79 86.48 69.93 14.52 59.02 Thursday, July 12, 2012 127 02 7.48 26.57 37.70 86.64 68.65 14.77 59.56 Friday, Juy 13, 2012 127.18 7.82 26.72 38 42 66.74 87 47 15.81 80.94 Monday, July 16, 2012 127.11 7.31 25.80 38.03 86.74 38 39 15.se 59.45 Tuesday, July 17, 2012 127 18 7.92 25.55 38 28 56 34 8.39 16.16 60.48 Wednesday, July 18, 2012 127 25 25.80 38.71 6607 85.43 1861 61.85 Thursday, July 19, 2012 127.15 7.28 26.03 38 23 26.12 88.06 16.06 82.52 Friday, July 20, 2012 127 18 7.07 25.79 37.90 66.22 38.77 16:45 81.05 Monday, July 23, 2012 127.15 7.09 25 77 3795 65.50 8815 16.6 80 31 Tuesday, July 24, 2012 127.18 7.04 25.72 3712 6527 Te 24 59.36 Wednesday, July 25, 2012 127 20 7.07 25.60 08.82 352 245 17230 59.39 Thursday, July 20, 2012 127 48 7.17 26.00 3730 853 86.35 1701 60.60 Friday, Juy 27 2012 731 27.07 39.45 8746 8837 6370 Monday, July 30, 2012 728 26.00 35 36 83.07 38.00 2 1.09 Tuesday, July 31, 2012 7.34 25 37 39 20 873 da o 07.12 80.72 7.53 78.25 78.25 78.36 74.92 74.29 74 25 75.23 74.58 76.06 78 23 78.84 75.86 75.21 24.03 72.39 73.40 7238 74.00 79.86 892 31804 12.04 128 63 10.77817 bio Shares Outstanong 1228 Don 5259 49.95 OR 38. man Goodrich purchase and co2 Duke Energy Conces : Following tersectory Toges Mert sose UN 2 -604 res outstanding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts