Question: Exercise 10-14 Installment note with equal total payments LO C1, P5 On January 1, 2013, Eagle borrows $21,000 cash by signing a four-year, 5% installment

Exercise 10-14 Installment note with equal total payments LO C1, P5

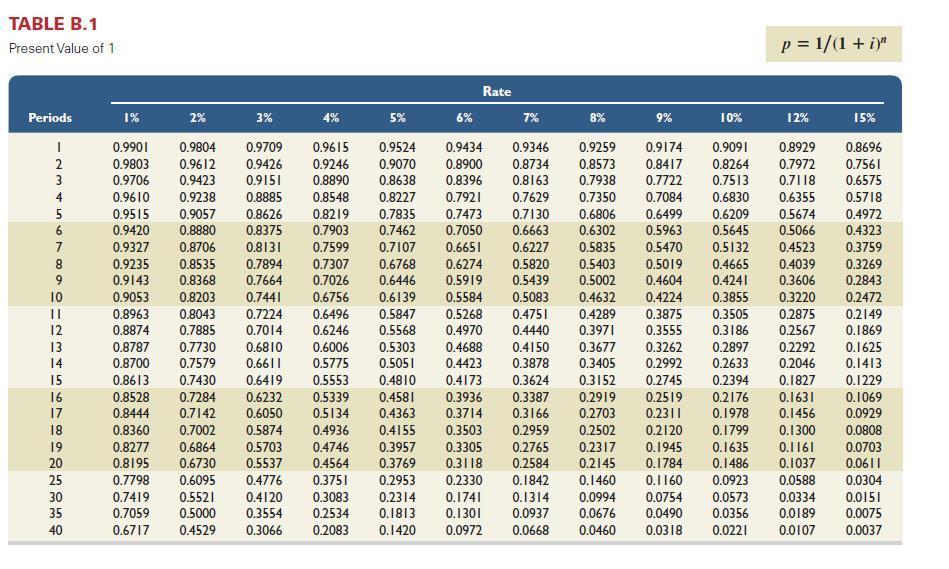

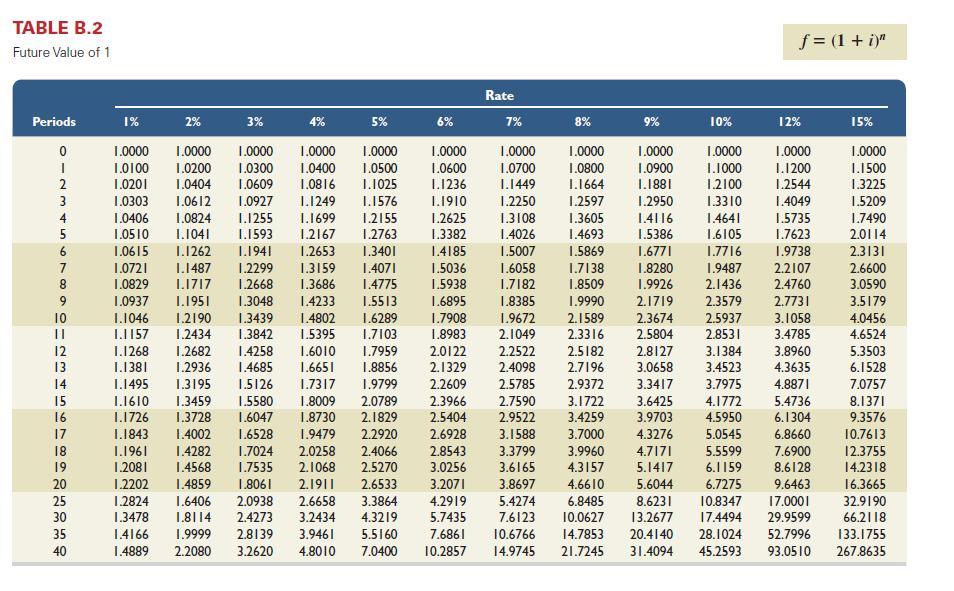

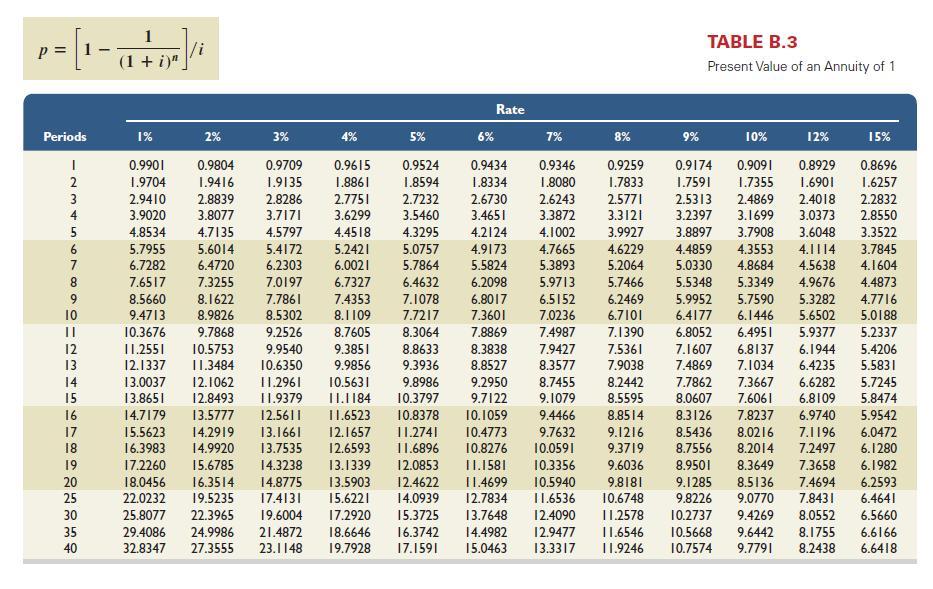

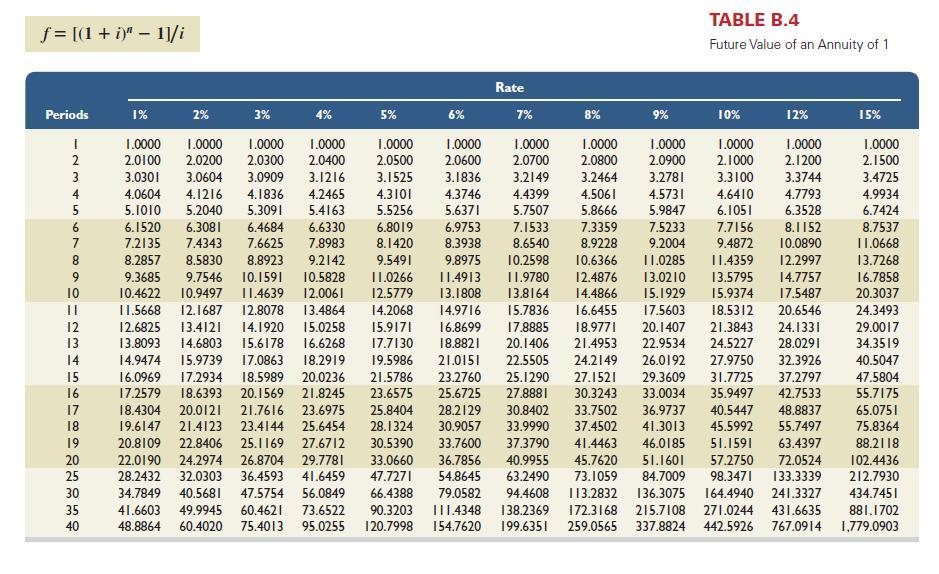

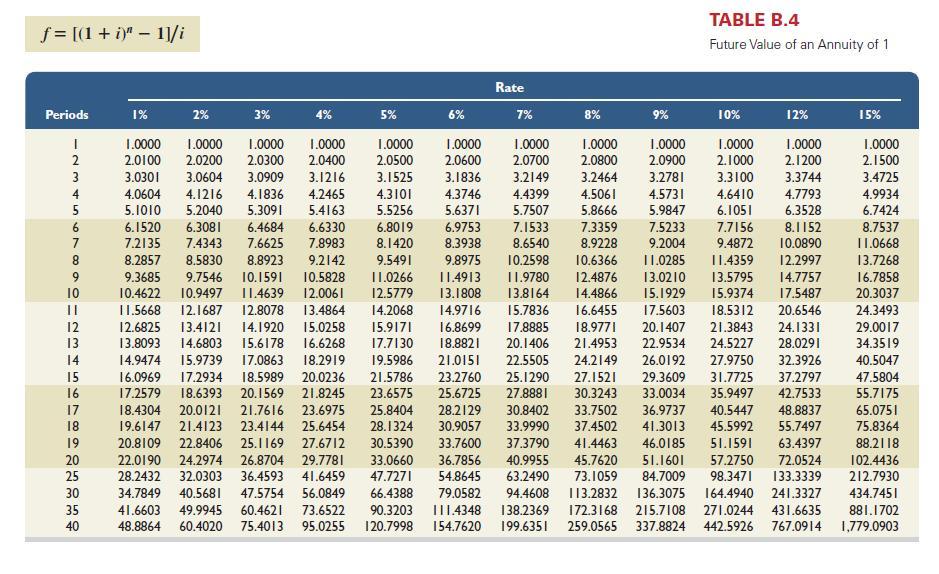

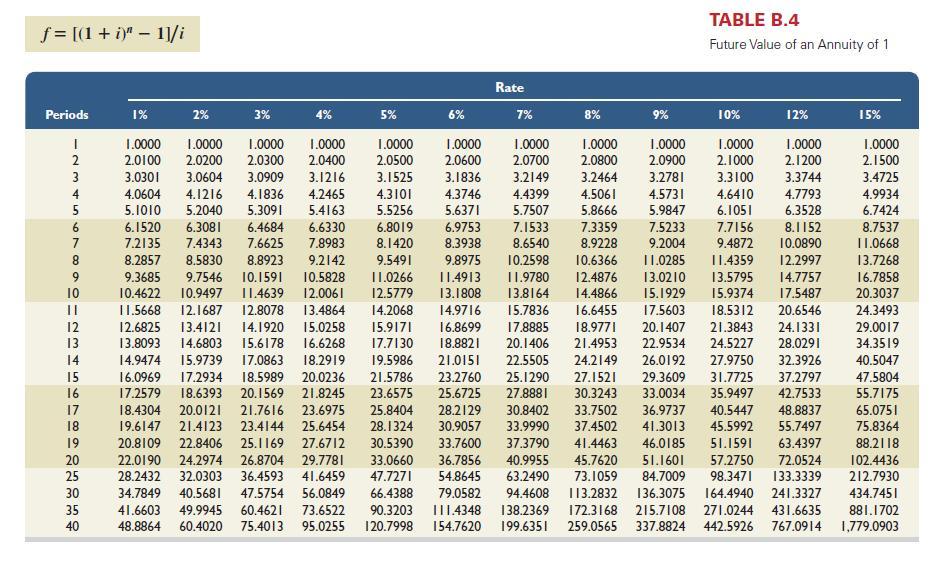

On January 1, 2013, Eagle borrows $21,000 cash by signing a four-year, 5% installment note. The note requires four equal total payments of accrued interest and principal on December 31 of each year from 2013 through 2016. (Table B.1, Table B.2, Table B.3, and Table B.4) (Use appropriate factor(s) from the tables provided.) |

| 1. | Compute the amount of each of the four equal total payments. |

|

2.Prepare an amortization table for this installment note. (Round your intermediate calculations to the nearest dollar amount.)

| Payments | |||||

| (A) | (B) | (C) | (D) | (E) | |

| Period | |||||

| Ending | Beginning | Debit Interest | Debit Notes | Credit | Ending |

| Date | Balance | Expense | Payable | Cash | Balance |

| 2013 | |||||

| 2014 | |||||

| 2015 | |||||

| 2016 | |||||

| Total | |||||

TABLE B.1 Present Value of 1 Periods I 2 681SWN 3 4 5 7 9 10 || 13 14 15 16 17 18 19 8888: 20 25 30 35 40 1% 2% 0.9901 0.9804 0.9709 0.9803 0.9612 0.9426 0.9706 0.9423 0.9151 0.9610 0.9238 0.8885 0.9515 0.9057 0.8626 0.8375 0.8131 0.9420 0.8880 0.9327 0.8706 0.9235 0.8535 0.9143 0.8360 0.8277 0.8195 0.9053 0.8963 0.8874 0.8787 0.8700 0.8613 0.7430 0.8528 0.8444 0.7798 0.7419 0.7059 0.6717 3% 0.6864 0.6730 0.6095 0.5521 0.5000 0.4529 0.7894 0.7307 0.8368 0.7664 0.7026 0.8203 0.7441 0.6756 0.8043 0.7224 0.6496 0.7885 0.7014 0.6246 0.7730 0.6810 0.6006 0.5303 0.7579 0.6611 0.5775 0.5051 0.6419 0.5553 0.7284 0.6232 0.5339 0.7142 0.7002 0.5874 4% 0.5703 0.5537 7% 0.9346 0.9259 0.9174 0.8734 0.8573 0.8417 0.9615 0.9524 0.9434 0.9246 0.9070 0.8900 0.8890 0.8638 0.8396 0.8163 0.8548 0.8227 0.7921 0.7629 0.8219 0.7835 0.7473 0.7130 0.7903 0.7462 0.7050 0.6663 0.7599 0.7938 0.7722 0.7350 0.7084 0.6806 0.6302 0.5963 0.7107 0.6651 0.6227 0.5835 0.5470 0.6768 0.6274 0.5820 0.5403 0.6446 0.5919 0.5439 0.5002 0.6139 0.5584 0.5083 0.4632 0.4751 0.5847 0.5268 0.4289 0.5568 0.4970 0.4440 0.3971 0.4688 0.4423 0.4776 0.4120 0.3554 0.3066 5% 0.4810 0.4173 0.4581 0.3936 0.6050 0.5134 0.4363 0.3714 0.4936 0.4155 0.3503 0.4746 0.3957 0.3305 0.4564 0.3769 0.3118 0.2953 0.2330 0.2314 0.1741 0.3751 0.1813 0.1301 0.1420 0.0972 Rate 0.3083 0.2534 0.2083 8% 9% p = 1/(1+i)n 10% 12% 0.9091 0.8929 0.8264 0.7972 0.7513 0.7118 0.6830 0.6355 15% 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.2149 0.1869 0.1625 0.1413 0.6499 0.6209 0.5674 0.5645 0.5066 0.5132 0.4523 0.5019 0.4665 0.4039 0.4604 0.4241 0.3606 0.4224 0.3855 0.3220 0.3505 0.2875 0.3186 0.2567 0.2897 0.2292 0.2633 0.2046 0.3875 0.3555 0.4150 0.3677 0.3262 0.3878 0.3405 0.2992 0.3624 0.3152 0.2745 0.2394 0.1827 0.3387 0.2919 0.2519 0.2176 0.1631 0.3166 0.2703 0.2311 0.1978 0.1456 0.2959 0.2502 0.2120 0.1799 0.1300 0.1161 0.0703 0.0611 0.0808 0.2765 0.2317 0.2584 0.2145 0.1842 0.1460 0.1314 0.0994 0.0937 0.0676 0.0668 0.0460 0.1945 0.1635 0.1784 0.1486 0.1037 0.1160 0.0923 0.0588 0.0754 0.0573 0.0334 0.0304 0.0151 0.0490 0.0356 0.0189 0.0075 0.0318 0.0221 0.0107 0.0037 0.1229 0.1069 0.0929

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

1 Compute the amount of each of the four equal total payments As per financial calculator ... View full answer

Get step-by-step solutions from verified subject matter experts