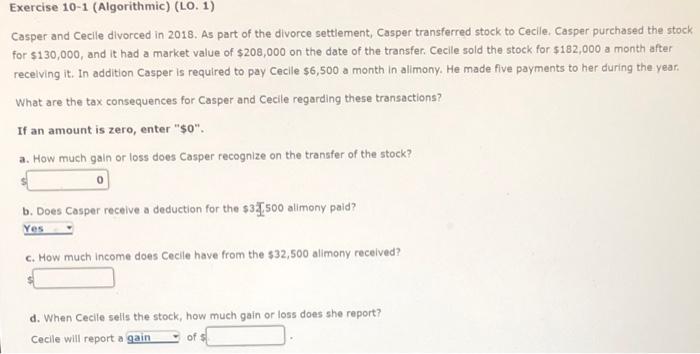

Question: Exercise 10-1 (Algorithmic) (LO. 1) Casper and Cecile divorced in 2018. As part of the divorce settlement, Casper transferred stock to Cecile. Casper purchased the

Exercise 10-1 (Algorithmic) (LO. 1) Casper and Cecile divorced in 2018. As part of the divorce settlement, Casper transferred stock to Cecile. Casper purchased the stock for $130,000, and it had a market value of $200,000 on the date of the transfer. Cecile sold the stock for $182,000 a month after receiving it. In addition Casper is required to pay Cecile $6,500 a month in allmony. He made five payments to her during the year. What are the tax consequences for Casper and Cecile regarding these transactions? If an amount is zero, enter "$0". a. How much gain or loss does Casper recognize on the transfer of the stock? 0 b. Does Casper receive a deduction for the $3.500 allmony paid? Yes C. How much Income does Cecile have from the $32,500 alimony received? d. When Cecile sells the stock, how much gain or loss does she report? Cecile will report a gain of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts