Question: Exercise 10-14 Notes payable with year-end adjustments LO3 Trista and Co. borrowed $190,000 on December 1, 2020, for 90 days at 6% interest by signing

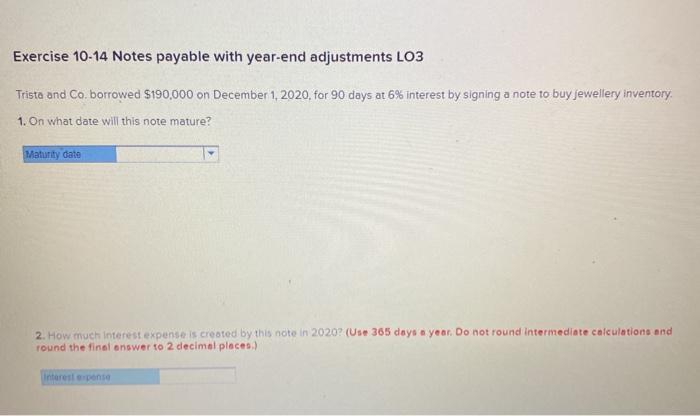

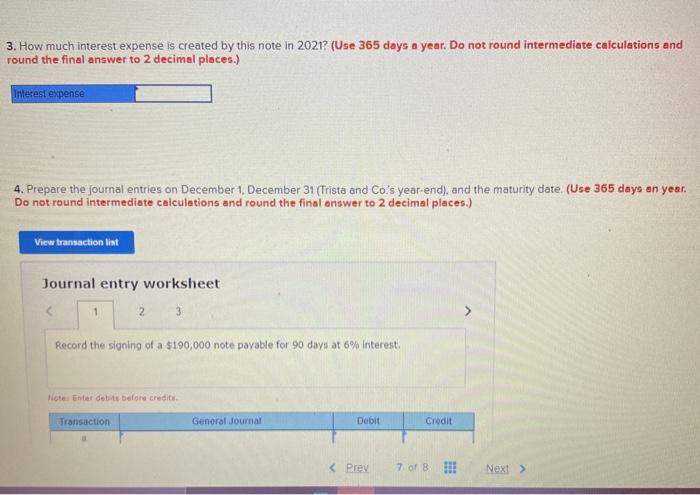

Exercise 10-14 Notes payable with year-end adjustments LO3 Trista and Co. borrowed $190,000 on December 1, 2020, for 90 days at 6% interest by signing a note to buy jewellery inventory 1. On what date will this note mature? Maturity date 2. How much interest expense is created by this note in 2020? (Use 365 days a year. Do not round Intermediate calculations and round the final answer to 2 decimal places:) Interest pense 3. How much interest expense is created by this note in 2021? (Use 365 days a year. Do not round intermediate calculations and round the final answer to 2 decimal places.) Interest expense 4. Prepare the journal entries on December 1, December 31 (Trists and Co's year-end), and the maturity date (Use 365 days an year. Do not round intermediate calculations and round the final answer to 2 decimal places.) View transaction list Journal entry worksheet 2 3 Record the signing of a $190,000 note payable for 90 days at 6% Interest Note Enter debut alone credite Transaction General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts