Question: EXERCISE 10-16A Exercise 10-16A Straight-line amortization for bonds issued at a discount On January 1, Year 1, Price Co. issued $190,000 of five-year, 6 percent

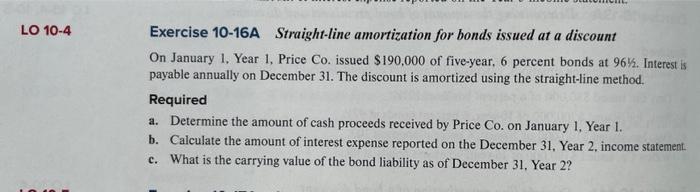

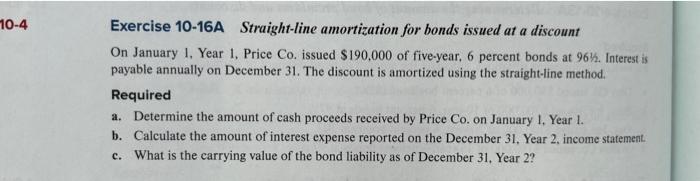

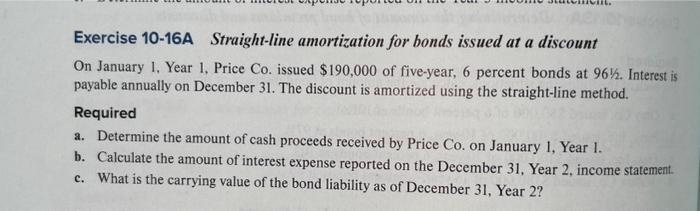

Exercise 10-16A Straight-line amortization for bonds issued at a discount On January 1, Year 1, Price Co. issued $190,000 of five-year, 6 percent bonds at 961/2. Interest is payable annually on December 31 . The discount is amortized using the straight-line method. Required a. Determine the amount of cash proceeds received by Price Co. on January 1 , Year 1. b. Calculate the amount of interest expense reported on the December 31 , Year 2 , income statement. c. What is the carrying value of the bond liability as of December 31 , Year 2 ? Exercise 10-16A Straight-line amortization for bonds issued at a discount On January 1, Year 1, Price Co. issued $190,000 of five-year, 6 percent bonds at 9612 . Interest is payable annually on December 31 . The discount is amortized using the straight-line method. Required a. Determine the amount of cash proceeds received by Price Co. on January I, Year I. b. Calculate the amount of interest expense reported on the December 31 , Year 2 , income statement. c. What is the carrying value of the bond liability as of December 31 , Year 2 ? Exercise 10-16A Straight-line amortization for bonds issued at a discount On January 1, Year 1, Price Co. issued $190,000 of five-year, 6 percent bonds at 96121. Interest is payable annually on December 31 . The discount is amortized using the straight-line method. Required a. Determine the amount of cash proceeds received by Price Co. on January 1, Year 1 . b. Calculate the amount of interest expense reported on the December 31 , Year 2 , income statement. c. What is the carrying value of the bond liability as of December 31 , Year 2 ? Exercise 16A: A. B. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts