Question: Exercise 10-20 (Algorithmic) (LO. 6) Donna donates stock in Chipper Corporation to the American Red Cross on September 10, 2019. She purchased the stock for

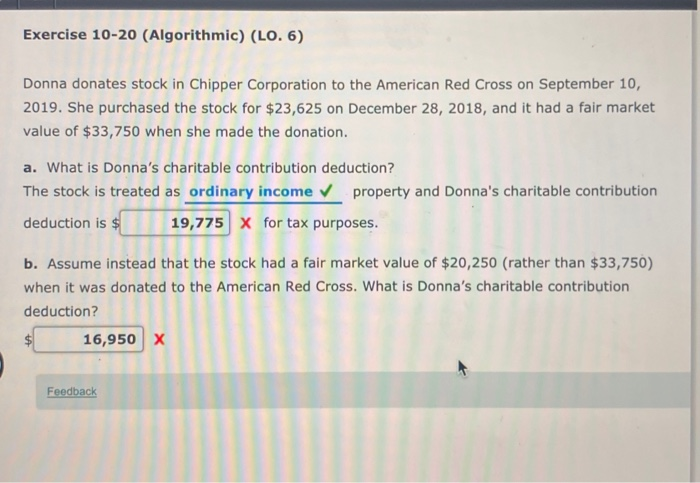

Exercise 10-20 (Algorithmic) (LO. 6) Donna donates stock in Chipper Corporation to the American Red Cross on September 10, 2019. She purchased the stock for $23,625 on December 28, 2018, and it had a fair market value of $33,750 when she made the donation. a. What is Donna's charitable contribution deduction? The stock is treated as ordinary income property and Donna's charitable contribution deduction is $ 19,775 X for tax purposes. b. Assume instead that the stock had a fair market value of $20,250 (rather than $33,750) when it was donated to the American Red Cross. What is Donna's charitable contribution deduction? 16,950 x Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts