Question: Exercise 10-20 (Part Level Submission) Isabelle Abiassi operates a popular summer camp for elementary school children. Projections for the current year are as follows: Sales

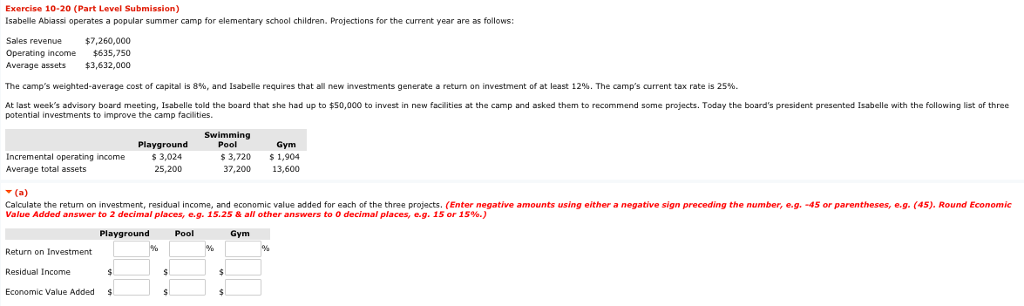

Exercise 10-20 (Part Level Submission) Isabelle Abiassi operates a popular summer camp for elementary school children. Projections for the current year are as follows: Sales revenue $7,260,000 Operating income $635,750 Average assets $3,632,000 The camp's weighted-average cost of capital is 8%, and Isabelle requires that all new investments generate a return on investment of at least 12%. The camp's current tax rate is 25%. At last week's advisory board meeting, Isabelle told the board that she had up to $50,000 to invest in new faclities at the camp and asked them to recommend some projects. Today the board's president presented Isabelle with the following list of three potential investments to improve the camp fadilities Swimming Pool $3,720 1,904 37,200 13,600 Gym Incremental operating income Average total assets 3,024 25,200 Calculate the retum on investment, residual income, and economic value added for each of the three projects, (Enter negative amounts using either a negative sign preceding the number, e.g.-45 or parentheses, e.g. (45), Round Economic Value Added answer to 2 decimal places, e.g. 15.25 & all other answers to 0 decimal places, e.g. 15 or 15%.) Playground Pool Gym Return on Investment Residual Income Economic Value Added $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts