Question: Exercise 10-20 (Static) Complete the accounting cycle using stockholders' equity transactions (LO10-2, 10-4, 10-5, 10-8). Thank you very much!! During January 2024 , the following

Exercise 10-20 (Static) Complete the accounting cycle using stockholders' equity transactions (LO10-2, 10-4, 10-5, 10-8).

Thank you very much!!

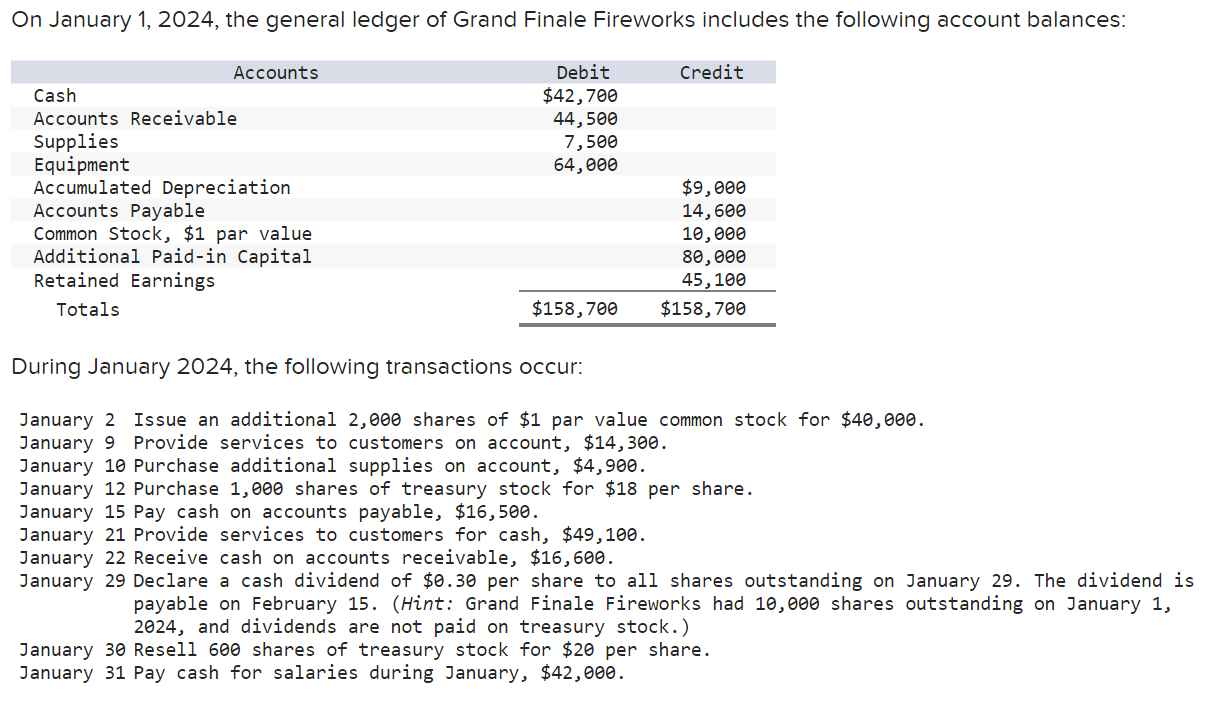

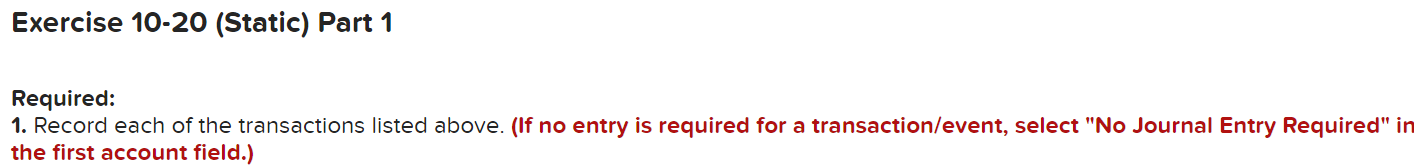

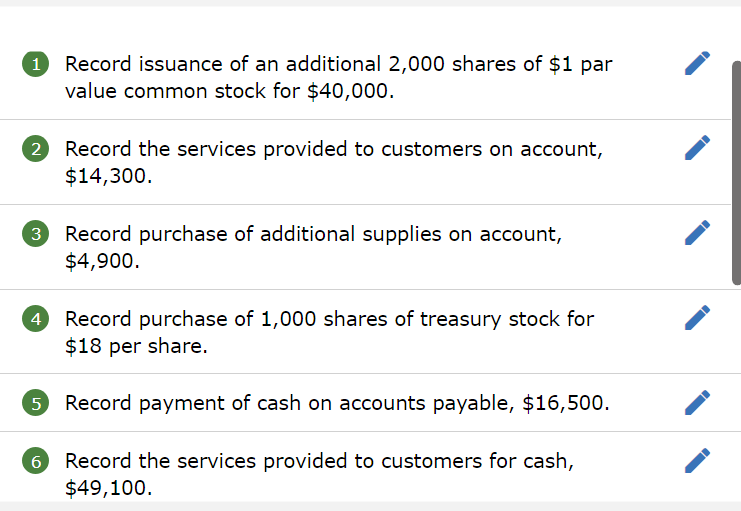

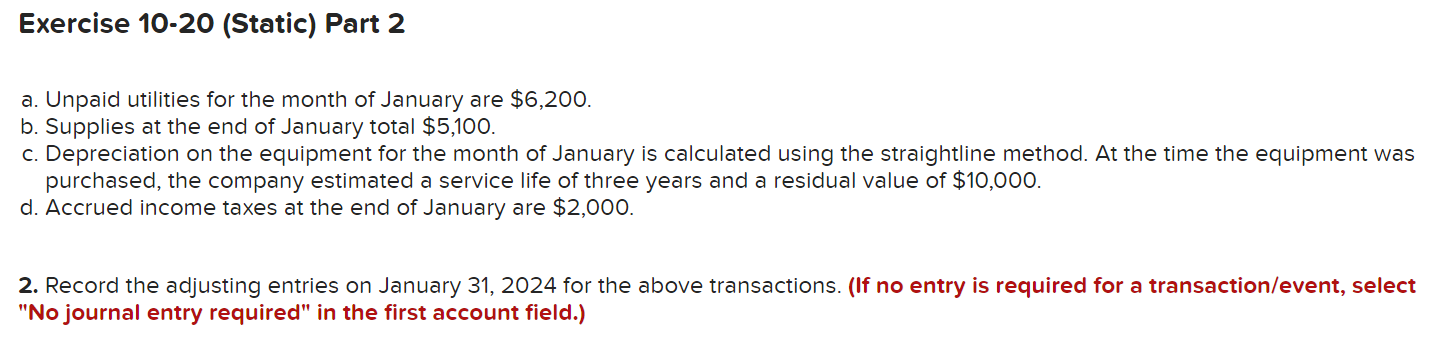

During January 2024 , the following transactions occur: January 2 Issue an additional 2,000 shares of $1 par value common stock for $40,000. January 9 Provide services to customers on account, $14,300. January 10 Purchase additional supplies on account, $4,900. January 12 Purchase 1,000 shares of treasury stock for $18 per share. January 15 Pay cash on accounts payable, $16,500. January 21 Provide services to customers for cash, $49,100. January 22 Receive cash on accounts receivable, $16,600. January 29 Declare a cash dividend of $0.30 per share to all shares outstanding on January 29 . The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 10,000 shares outstanding on January 1, 2024 , and dividends are not paid on treasury stock.) January 30 Resell 600 shares of treasury stock for $20 per share. January 31 Pay cash for salaries during January, $42,000. Exercise 10-20 (Static) Part 1 Required: 1. Record each of the transactions listed above. (If no entry is required for a transaction/event, select "No Journal Entry Required" ir the first account field.) Record issuance of an additional 2,000 shares of $1 par value common stock for $40,000. Record the services provided to customers on account, $14,300. Record purchase of additional supplies on account, $4,900. Record purchase of 1,000 shares of treasury stock for $18 per share. Record payment of cash on accounts payable, $16,500. Record the services provided to customers for cash, $49,100. Record the receipt of cash on accounts receivable, $16,600. Record the declaration of a cash dividend of $0.30 per share to all shares outstanding on January 29 . The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 10,000 shares outstanding on January 1, 2024 and dividends are not paid on treasury stock.) Record the resale of 600 shares of treasury stock for $20 per share. Record the payment of cash for salaries during January, $42,000. a. Unpaid utilities for the month of January are $6,200. b. Supplies at the end of January total $5,100. c. Depreciation on the equipment for the month of January is calculated using the straightline method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $10,000. d. Accrued income taxes at the end of January are $2,000. 2. Record the adjusting entries on January 31, 2024 for the above transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts