Question: Exercise 10-25 (Algorithmie) (LO, 2) The Wilmoths plan to purchase a house and would like to determine the after-tax cost of financing its purchase. Given

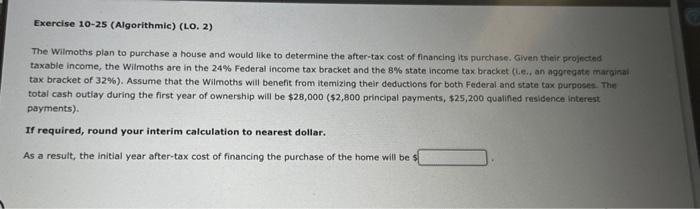

Exercise 10-25 (Algorithmie) (LO, 2) The Wilmoths plan to purchase a house and would like to determine the after-tax cost of financing its purchase. Given theit projected taxable income, the Wilmoths are in the 24% Federal income tax bracket and the 8% state income tax bracket (L.e., an agaregate marpiraif tax bracket of 32% ). Assume that the Wilmoths will benefit from itemizing their deductions for both Federal and stata tax purposet Thir total cash outlay during the first year of ownership will be $28,000($2,800 princlpal payments, $25,200 qualifed residence interest payments). If required, round your interim calculation to nearest dollar. As a result, the initial year after-tax cost of financing the purchase of the home will be s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts