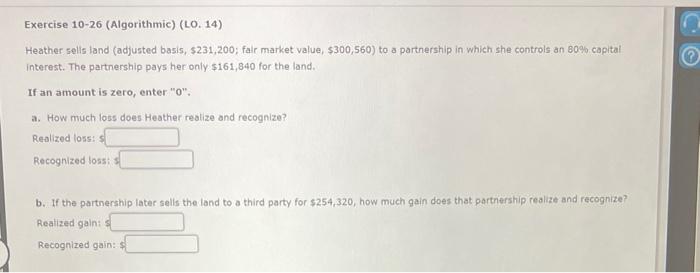

Question: Exercise 10-26 (Algorithmic) (LO. 14) Heather selis land (adjusted basis, $231,200; fale market value, $300,560 ) to a partnership in which she controls an 80%

Exercise 10-26 (Algorithmic) (LO. 14) Heather selis land (adjusted basis, $231,200; fale market value, $300,560 ) to a partnership in which she controls an 80% capital interest. The partnership pays her only $161,840 for the land. If an amount is zero, enter "0". a. How much loss does Heather reatize and recognize? Realized loss: 5 Recognized loss: 5 b. If the partnership later selis the land to a third party for $254,320, how much gain does that partnership realize and recognize? Reatized gain: 1 Recognized gain: $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts