Question: Exercise 10-5A (Algo) Determining net present value LO 10-2 Adams Company is considering investing in two new vans that are expected to generate combined cash

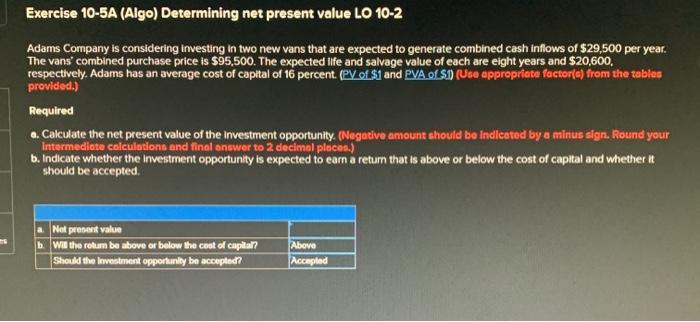

Exercise 10-5A (Algo) Determining net present value LO 10-2 Adams Company is considering investing in two new vans that are expected to generate combined cash inflows of $29,500 per year. The vans' combined purchase price is $95,500. The expected life and salvage value of each are eight years and $20,600. respectively. Adams has an average cost of capital of 16 percent. (CV_of_$1 and PVA of S1) (Ute appropriate factor(a) from the tables provided.) Required a. Calculate the net present value of the Investment opportunity. (Negative amount should be Indicated by a minus sign. Round your intermediate calculation and final answer to 2 decimal placen.) b. Indicate whether the Investment opportunity is expected to earn a return that is above or below the cost of capital and whether in should be accepted Not present value b Will the retum be above or below the cost of capilar Should the Investment opportunity be accepted? Above Accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts