Question: Exercise 10.7 (Static) Journalizing payroll transactions. LO 10-7 On July 31, the payroll register for Red Company showed the following totals for the month: gross

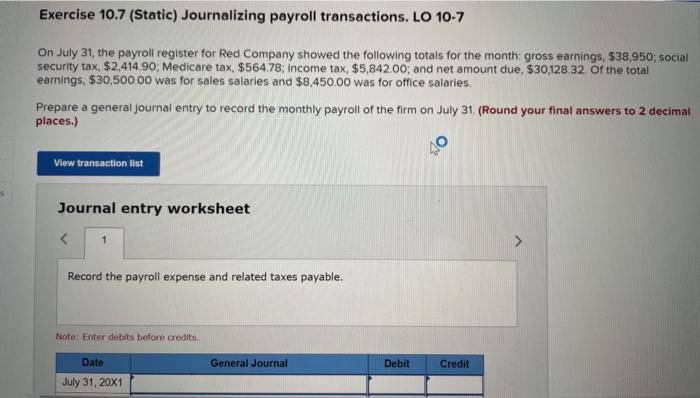

Exercise 10.7 (Static) Journalizing payroll transactions. LO 10-7 On July 31, the payroll register for Red Company showed the following totals for the month: gross earnings, $38,950: social security tax, $2,414.90: Medicare tax, $56478, income tax, $5,842.00; and net amount due, $30,128 32. Of the total earings $30,500.00 was for sales salaries and $8,450.00 was for office salaries Prepare a general journal entry to record the monthly payroll of the firm on July 31. (Round your final answers to 2 decimal places.) View transaction list Journal entry worksheet 1 Record the payroll expense and related taxes payable. Note: Enter debits before credits General Journal Debit Credit Date July 31, 20X1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts