Question: Exercise 10-8 (Part Level Submission) On December 31, 2016, Teal Inc. borrowed $3,900,000 at 12% payable annually to finance the construction of a new building.

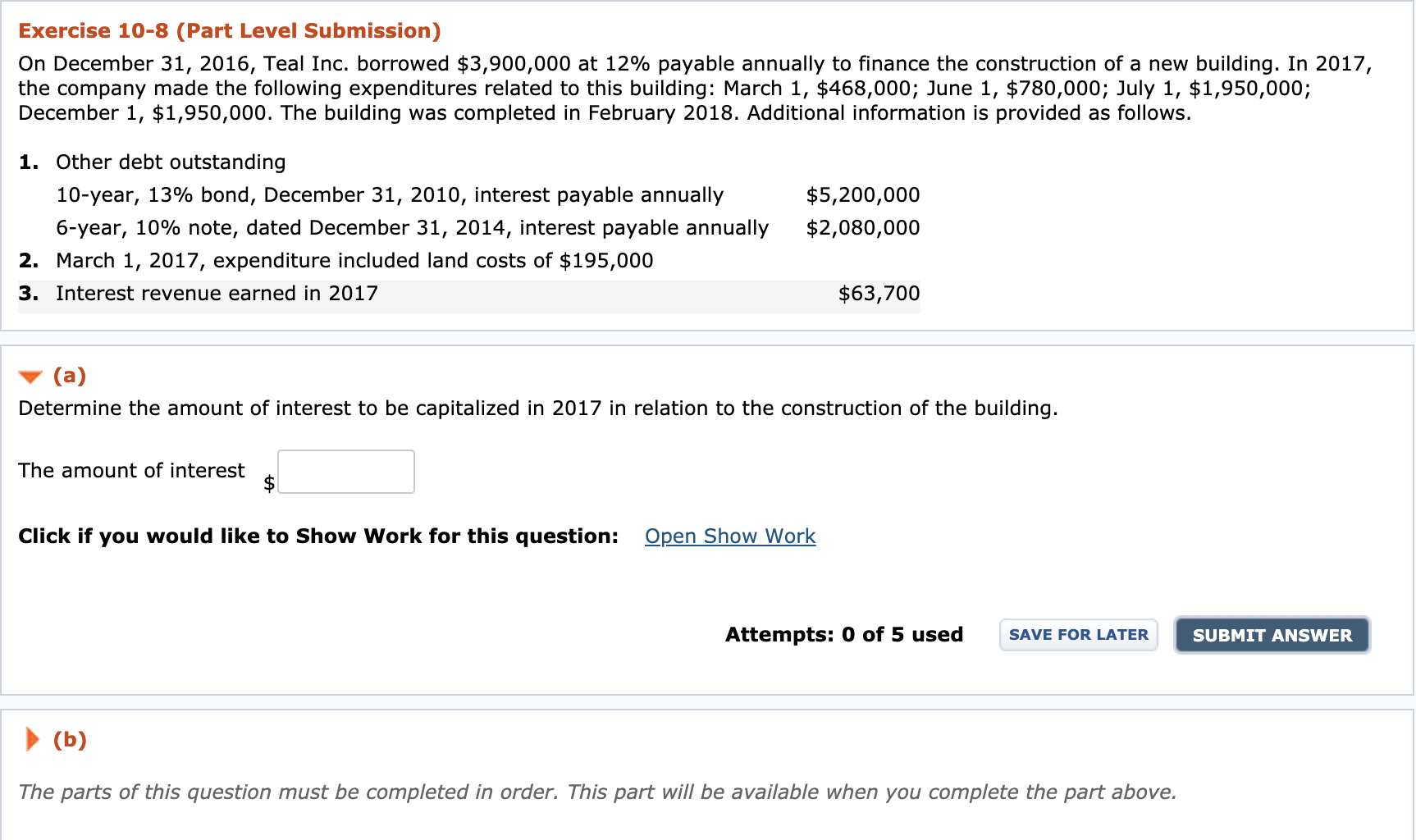

Exercise 10-8 (Part Level Submission) On December 31, 2016, Teal Inc. borrowed $3,900,000 at 12% payable annually to finance the construction of a new building. In 2017, the company made the following expenditures related to this building: March 1, $468,000; June 1, $780,000; July 1, $1,950,000; December 1, $1,950,000. The building was completed in February 2018. Additional information is provided as follows. 1. Other debt outstanding 10-year, 13% bond, December 31, 2010, interest payable annually 6-year, 10% note, dated December 31, 2014, interest payable annually 2. March 1, 2017, expenditure included land costs of $195,000 3. Interest revenue earned in 2017 $5,200,000 $2,080,000 $63,700 (a) Determine the amount of interest to be capitalized in 2017 in relation to the construction of the building. The amount of interest Click if you would like to Show Work for this question: Open Show Work Attempts: 0 of 5 used SAVE FOR LATER SUBMIT ANSWER (b) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts