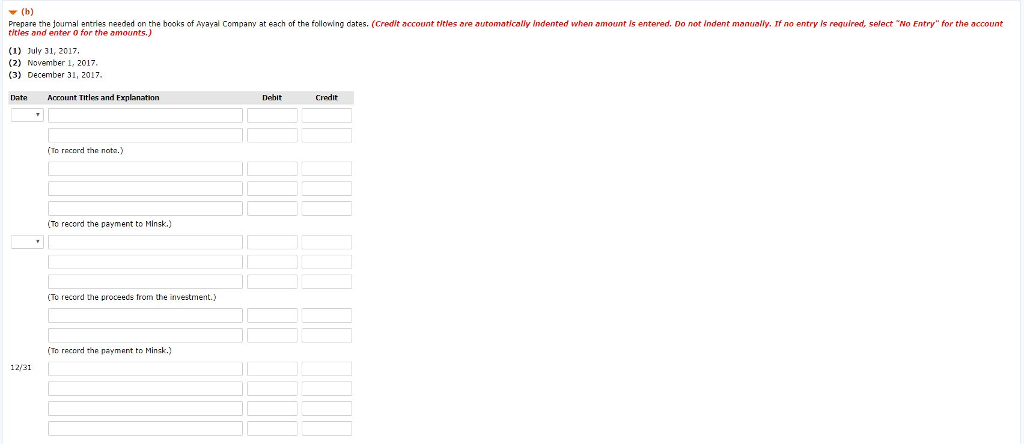

Question: Exercise 10-9 (Part Level Submission) Part B. Prepare the journal entries needed on the books of Ayayai Company at each of the following dates. Exerdise

Exercise 10-9 (Part Level Submission) Part B. Prepare the journal entries needed on the books of Ayayai Company at each of the following dates.

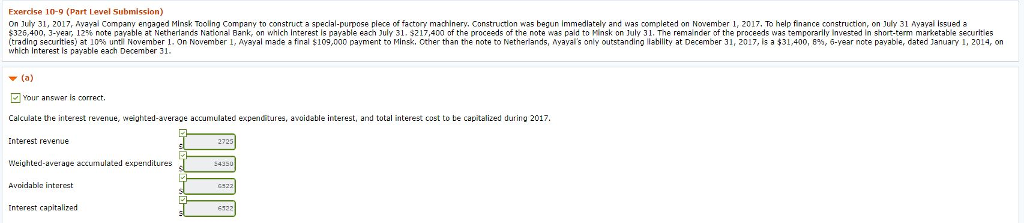

Exerdise 10-9 (Part Level Submission) On July 31, 2017, Ayayal Company engaged Minsk Tooling Company to construct a special-purpose plece of factory machinery, Construction was begun immediately and was completed on November 1, 2017, To help finance construction, on July 31 Ayayal issued a $326 400 3-year, 12% note payable at Netherlands Nadona Bank, on wnich terest is payable eac J Y 31 $217,400 o the proceeds of t e note as paid to Minsk on July 31. The remanoer of the proceeds was temporarity invested in short-term marketable securities trading securities at 109 unt November 1 On November 1 Aya a made a final $109 000 pay ent to Minsk ner than the note to Netherlands Myayal's only outstanding lab lity at Dece ber 31 2017, s a 31 400 69 year note pavable, dated January 1, 2014, on which Interest Is payable each December 31 secu ,400, 8%,6-yearncte Your answer is correct Calculate the interest revenue, weighted-average accumulated expendures, avoidable interest, and total interest cost to be capitalized during 2017. nterest revenue Weighted-averaue Avcidable intercst tnterest capitalized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts