Question: Exercise 1.1 Term Structure Construction For the Treasury curve with the data given below. Tenor 1 Price 100 100 2 3 100 100 Coupon Con

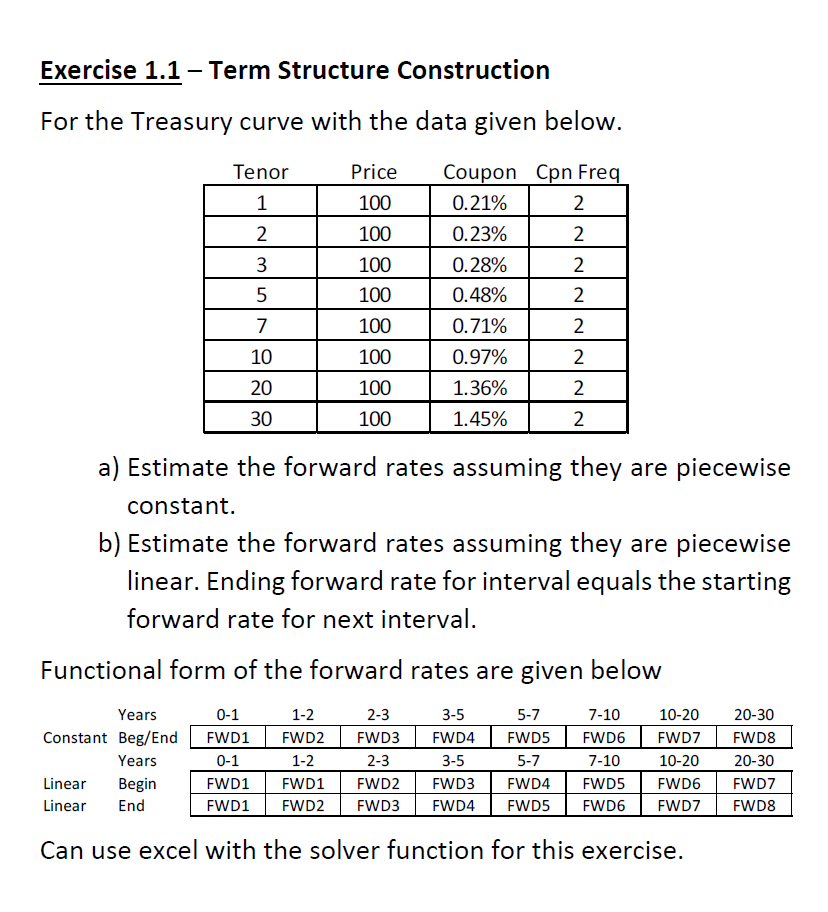

Exercise 1.1 Term Structure Construction For the Treasury curve with the data given below. Tenor 1 Price 100 100 2 3 100 100 Coupon Con Freq 0.21% 2 0.23% 2 0.28% 2 0.48% 2 0.71% 2 0.97% 2 1.36% 2 5 7 100 100 10 20 100 100 30 1.45% 2 a) Estimate the forward rates assuming they are piecewise constant. b) Estimate the forward rates assuming they are piecewise linear. Ending forward rate for interval equals the starting forward rate for next interval. Functional form of the forward rates are given below Years Constant Beg/End Years Linear Begin Linear End 0-1 FWD1 0-1 FWD1 FWD1 1-2 FWD2 1-2 FWD1 FWD2 2-3 FWD3 2-3 FWD2 FWD3 3-5 FWD4 3-5 FWD3 FWD4 5-7 FWD5 5-7 FWD4 FWD5 7-10 FWD6 7-10 FWD5 FWD6 10-20 FWD7 10-20 FWD6 FWD7 20-30 FWD8 20-30 FWD7 FWD8 Can use excel with the solver function for this exercise. Exercise 1.1 Term Structure Construction For the Treasury curve with the data given below. Tenor 1 Price 100 100 2 3 100 100 Coupon Con Freq 0.21% 2 0.23% 2 0.28% 2 0.48% 2 0.71% 2 0.97% 2 1.36% 2 5 7 100 100 10 20 100 100 30 1.45% 2 a) Estimate the forward rates assuming they are piecewise constant. b) Estimate the forward rates assuming they are piecewise linear. Ending forward rate for interval equals the starting forward rate for next interval. Functional form of the forward rates are given below Years Constant Beg/End Years Linear Begin Linear End 0-1 FWD1 0-1 FWD1 FWD1 1-2 FWD2 1-2 FWD1 FWD2 2-3 FWD3 2-3 FWD2 FWD3 3-5 FWD4 3-5 FWD3 FWD4 5-7 FWD5 5-7 FWD4 FWD5 7-10 FWD6 7-10 FWD5 FWD6 10-20 FWD7 10-20 FWD6 FWD7 20-30 FWD8 20-30 FWD7 FWD8 Can use excel with the solver function for this exercise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts