Question: Exercise 11-11 Comparison of Projects Using Net Present Value Labeau Products, Ltd., of Perth, Australia, has $12,000 to invest. The company is trying to decide

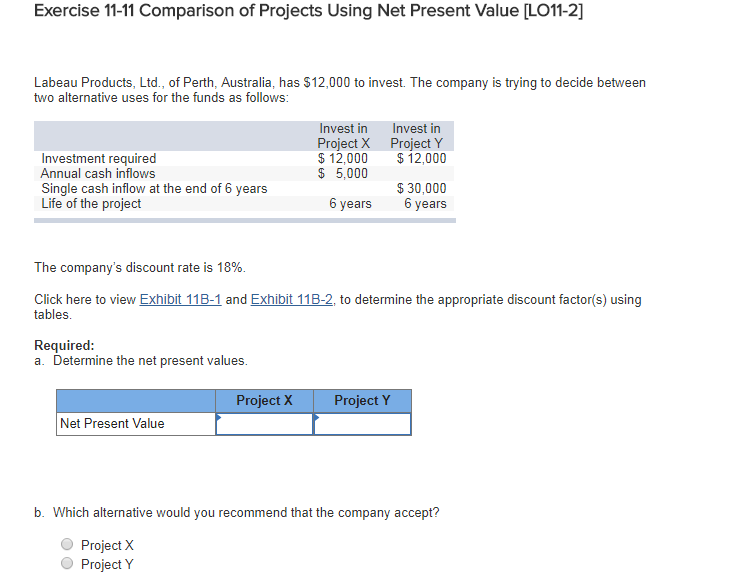

Exercise 11-11 Comparison of Projects Using Net Present Value

| Labeau Products, Ltd., of Perth, Australia, has $12,000 to invest. The company is trying to decide between two alternative uses for the funds as follows: http://lectures.mhhe.com/connect/0078025419/Exhibit/Exhibit%2011B-1.JPG Exhibit 11B-1 http://lectures.mhhe.com/connect/0078025419/Exhibit/Exhibit%2011B-2.JPG Exhibit 11B-2

|

Exercise 11-11 Comparison of Projects Using Net Present Value [LO11-2] Labeau Products, Ltd., of Perth, Australia, has $12,000 to invest. The company is trying to decide between two alternative uses for the funds as follows Invest in nvest in Project XProjectY $12,000 12,000 Investment required Annual cash inflows Single cash inflow at the end of 6 years Life of the project $ 5,000 $30,000 6 years 6 years The company's discount rate is 18% Click here to view Exhibit 11B-1 and Exhibit 11B-2, to determine the appropriate discount factor(s) using tables Required a. Determine the net present values Project X Project Y Net Present Value b. Which alternative would you recommend that the company accept? O Project X ProjectY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts