Question: Exercise 11-15 (Algo) Preparing stockholders' equity section LO P1, C2, P3, C3 In Draco Corporation's first year of business, the following transactions affected its equity

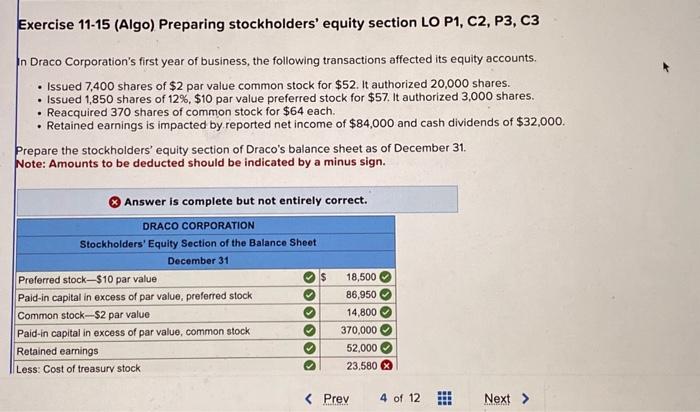

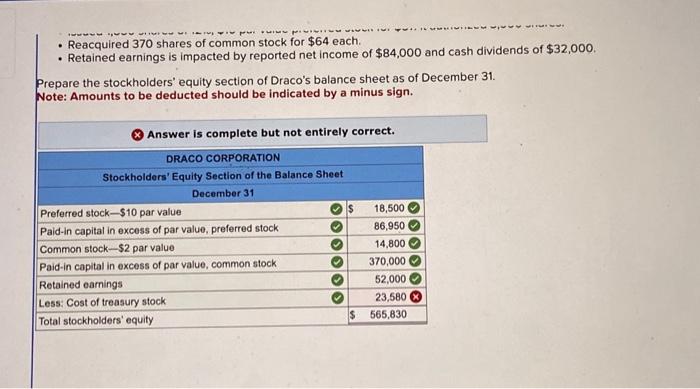

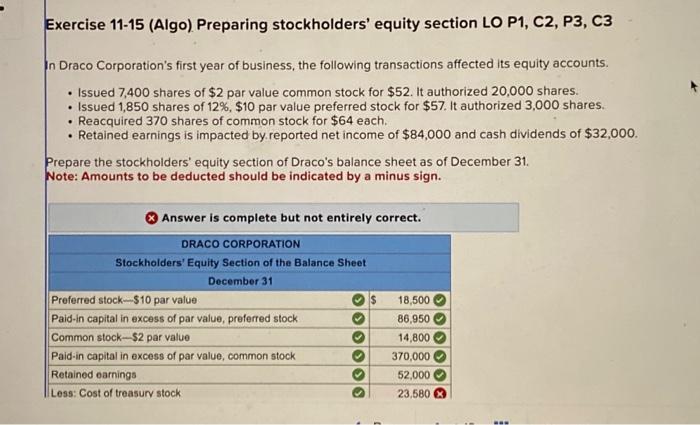

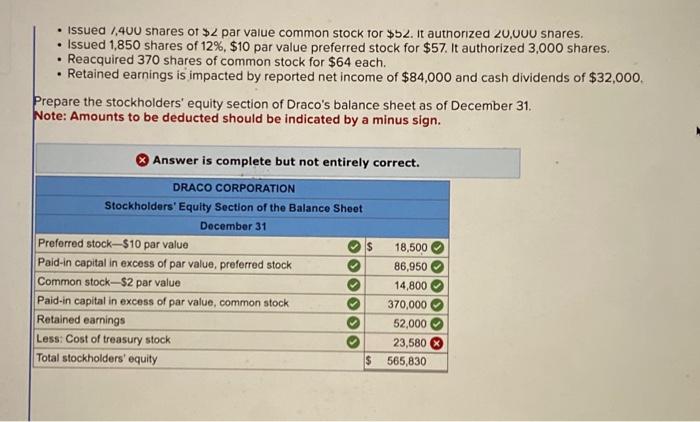

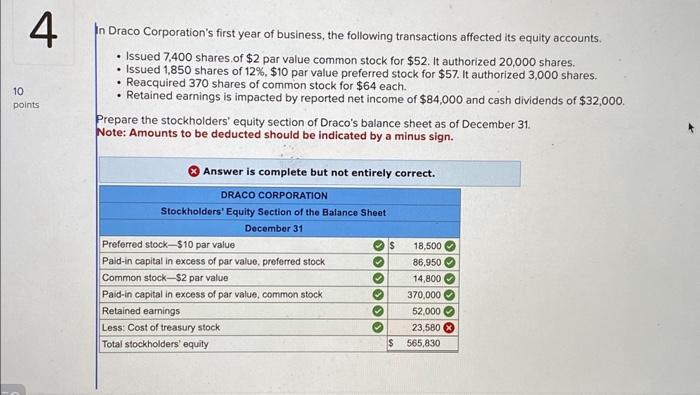

Exercise 11-15 (Algo) Preparing stockholders' equity section LO P1, C2, P3, C3 In Draco Corporation's first year of business, the following transactions affected its equity accounts. - Issued 7,400 shares of $2 par value common stock for $52. It authorized 20,000 shares. - Issued 1,850 shares of 12%,$10 par value preferred stock for $57. It authorized 3,000 shares. - Reacquired 370 shares of common stock for $64 each. - Retained earnings is impacted by reported net income of $84,000 and cash dividends of $32,000. Prepare the stockholders' equity section of Draco's balance sheet as of December 31 . Note: Amounts to be deducted should be indicated by a minus sign. - Reacquired 370 shares of common stock for $64 each. - Retained earnings is impacted by reported net income of $84,000 and cash dividends of $32,000. Prepare the stockholders' equity section of Draco's balance sheet as of December 31 . Note: Amounts to be deducted should be indicated by a minus sign. Exercise 11-15 (Algo) Preparing stockholders' equity section LO P1, C2, P3, C3 In Draco Corporation's first year of business, the following transactions affected its equity accounts. - Issued 7,400 shares of $2 par value common stock for $52. It authorized 20,000 shares. - Issued 1,850 shares of 12%,$10 par value preferred stock for $57. It authorized 3,000 shares. - Reacquired 370 shares of common stock for $64 each. - Retained earnings is impacted by. reported net income of $84,000 and cash dividends of $32,000. Prepare the stockholders' equity section of Draco's balance sheet as of December 31 . Note: Amounts to be deducted should be indicated by a minus sign. - Issued 1,400 snares of $ par value common stock tor $5. It authorized U,U snares. - Issued 1,850 shares of 12%,$10 par value preferred stock for $57. It authorized 3,000 shares. - Reacquired 370 shares of common stock for $64 each. - Retained earnings is impacted by reported net income of $84,000 and cash dividends of $32,000, Prepare the stockholders' equity section of Draco's balance sheet as of December 31 . Note: Amounts to be deducted should be indicated by a minus sign. In Draco Corporation's first year of business, the following transactions affected its equity accounts. - Issued 7,400 shares of $2 par value common stock for $52. It authorized 20,000 shares. - Issued 1,850 shares of 12%,$10 par value preferred stock for $57. It authorized 3,000 shares. - Reacquired 370 shares of common stock for $64 each. - Retained earnings is impacted by reported net income of $84,000 and cash dividends of $32,000. Prepare the stockholders' equity section of Draco's balance sheet as of December 31 . Note: Amounts to be deducted should be indicated by a minus sign. Exercise 11-15 (Algo) Preparing stockholders' equity section LO P1, C2, P3, C3 In Draco Corporation's first year of business, the following transactions affected its equity accounts. - Issued 7,400 shares of $2 par value common stock for $52. It authorized 20,000 shares. - Issued 1,850 shares of 12%,$10 par value preferred stock for $57. It authorized 3,000 shares. - Reacquired 370 shares of common stock for $64 each. - Retained earnings is impacted by reported net income of $84,000 and cash dividends of $32,000. Prepare the stockholders' equity section of Draco's balance sheet as of December 31 . Note: Amounts to be deducted should be indicated by a minus sign. - Reacquired 370 shares of common stock for $64 each. - Retained earnings is impacted by reported net income of $84,000 and cash dividends of $32,000. Prepare the stockholders' equity section of Draco's balance sheet as of December 31 . Note: Amounts to be deducted should be indicated by a minus sign. Exercise 11-15 (Algo) Preparing stockholders' equity section LO P1, C2, P3, C3 In Draco Corporation's first year of business, the following transactions affected its equity accounts. - Issued 7,400 shares of $2 par value common stock for $52. It authorized 20,000 shares. - Issued 1,850 shares of 12%,$10 par value preferred stock for $57. It authorized 3,000 shares. - Reacquired 370 shares of common stock for $64 each. - Retained earnings is impacted by. reported net income of $84,000 and cash dividends of $32,000. Prepare the stockholders' equity section of Draco's balance sheet as of December 31 . Note: Amounts to be deducted should be indicated by a minus sign. - Issued 1,400 snares of $ par value common stock tor $5. It authorized U,U snares. - Issued 1,850 shares of 12%,$10 par value preferred stock for $57. It authorized 3,000 shares. - Reacquired 370 shares of common stock for $64 each. - Retained earnings is impacted by reported net income of $84,000 and cash dividends of $32,000, Prepare the stockholders' equity section of Draco's balance sheet as of December 31 . Note: Amounts to be deducted should be indicated by a minus sign. In Draco Corporation's first year of business, the following transactions affected its equity accounts. - Issued 7,400 shares of $2 par value common stock for $52. It authorized 20,000 shares. - Issued 1,850 shares of 12%,$10 par value preferred stock for $57. It authorized 3,000 shares. - Reacquired 370 shares of common stock for $64 each. - Retained earnings is impacted by reported net income of $84,000 and cash dividends of $32,000. Prepare the stockholders' equity section of Draco's balance sheet as of December 31 . Note: Amounts to be deducted should be indicated by a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts