Question: Exercise 11-16A (Algo) Variable costing versus absorption costing LO 11-4 Perez Company incurred manufacturing overhead cost for the year as follows. Direct materials Direct

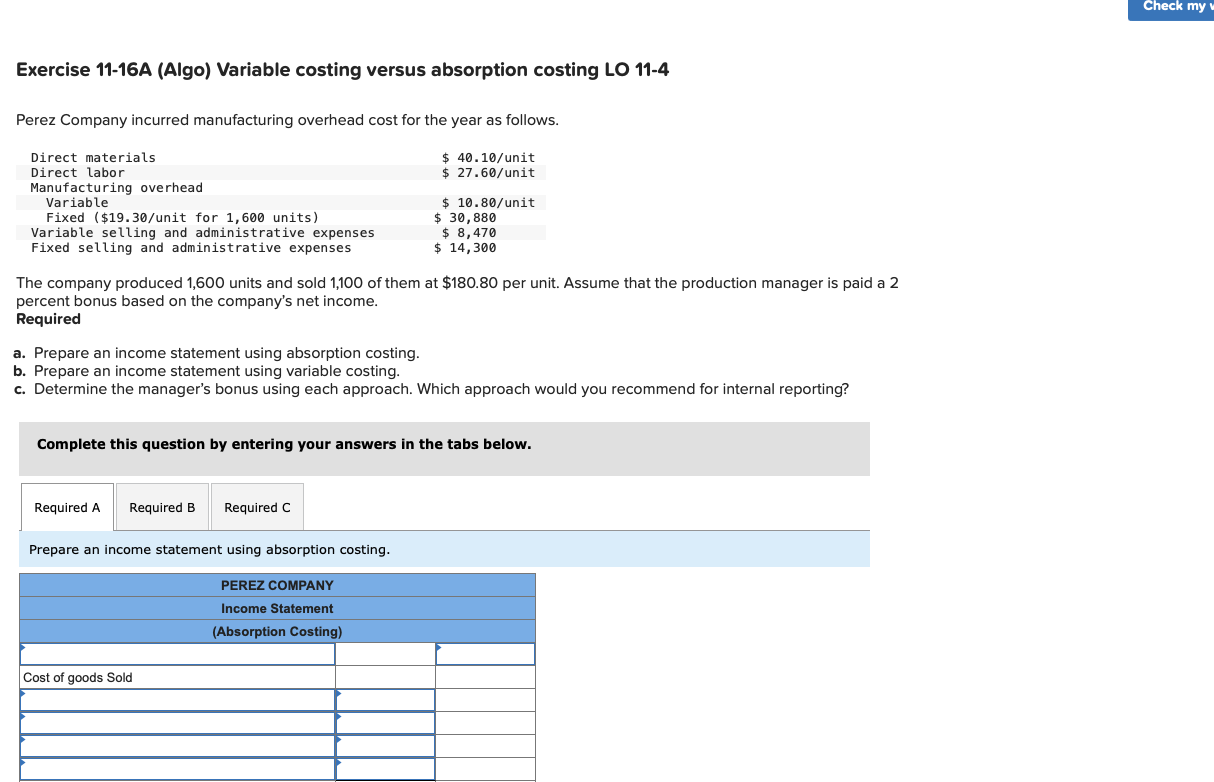

Exercise 11-16A (Algo) Variable costing versus absorption costing LO 11-4 Perez Company incurred manufacturing overhead cost for the year as follows. Direct materials Direct labor Manufacturing overhead Variable Fixed ($19.30/unit for 1,600 units) Variable selling and administrative expenses Fixed selling and administrative expenses $ 40.10/unit $ 27.60/unit $ 10.80/unit $ 30,880 $ 8,470 $ 14,300 The company produced 1,600 units and sold 1,100 of them at $180.80 per unit. Assume that the production manager is paid a 2 percent bonus based on the company's net income. Required a. Prepare an income statement using absorption costing. b. Prepare an income statement using variable costing. c. Determine the manager's bonus using each approach. Which approach would you recommend for internal reporting? Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare an income statement using absorption costing. PEREZ COMPANY Income Statement (Absorption Costing) Cost of goods Sold Check my

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts